How to Choose the Best Calculator for Retirement Planning

No one finds retirement planning easy, but knowing how much money one should have saved gets even more complex. Knowing your requirements through a retirement calculator will give you a clearer picture of how much you will need for your retirement. Now, when there are so many calculators for retirement, the right choice is crucial. It will help the retirement calculator user make informed decisions about their future.

Here's how you can choose the best calculator for retirement that suits your financial situation:

Understand Your Retirement Goals

The first step in choosing a retirement calculator is clearly understanding your retirement goals. Think about factors such as:

-

Desired retirement age: How old do you want to be when you retire?

-

Lifestyle expectations: What lifestyle do you expect to carry into retirement? Are you considering downsizing or traveling?

-

Post-retirement expenses: What will your living expenses like health care, housing, and perhaps most significant leisure time activities?

Look for Customization Options

Not all retirement calculators are created equal. Many provide rough estimates based on general assumptions, while others may let you customize inputs. To get your best and most accurate calculations, look for a calculator that enables you to enter personalized data, such as:

-

Current savings and investments

-

Expected future savings

-

Inflation rates

-

Income sources in retirement (like Social Security or pensions)

The best calculators for retirement planning will account for variables like inflation, life expectancy, and different sources of income.

Ease of Use

Retirement planning is complicated; a confusing calculator is the last thing you need. Opt for a tool with an intuitive interface, explaining clearly what inputs are required and the nature of the output generated. If you're not inclined to complex financial calculations, a calculator showing information in a simple, intuitive format with graphs or charts might appeal to you.

Many calculators also enable you to change your retirement age or contribution rate and see how that change would affect your overall plan. This feature can be particularly useful in helping you explore different retirement paths.

Accuracy of Assumptions

A key element to consider is the accuracy of the calculator's assumptions. Some calculators use basic assumptions, like average investment returns or inflation rates. The better calculators allow you to alter these assumptions according to your expectations. For example, if you expect the money you invested in different instruments to return less than it usually does, you could feed such data into the software, making such projections more realistic.

Includes Tax Considerations

Taxes are one of the primary sources of impact on retirement income. Not all calculators include taxes, so it is essential to find which calculators allow you to enter the taxes paid on Social Security benefits, withdrawals from traditional retirement accounts, and capital gains on investments. Using tax liabilities will help you better understand how much after-tax retirement income you would have, making your planning more effective.

Provides Actionable Insights

A good retirement calculator doesn’t just give you a number; it provides actionable advice to reach your retirement goals. Some calculators offer insights such as:

-

How much you should be saving monthly or annually to meet your retirement goals

-

The expected shortfall if your current savings plan isn’t sufficient

-

How adjustments in your spending or saving habits can improve your retirement outlook

Look for a calculator that offers specific suggestions tailored to your financial situation so you can make informed decisions.

Reputation and Reviews

Research a retirement calculator's reputation before choosing one. Look for reviews or expert opinions that show whether it has been praised for its accuracy and ease of use. Most reputable financial institutions offer retirement calculators, usually good places to begin. Banks, investment firms, and government resources generally provide accessible and reliable calculators trusted by financial professionals.

Free vs. Paid Calculators

While many free calculators provide good general guidance, some individuals may prefer a paid tool that offers more detailed, personalized insights. Paid calculators may include features like access to a financial advisor or more complex scenario analysis.

However, free calculators offered by trusted financial institutions or government websites are typically more than sufficient for most individuals.

Conclusion

Choosing a retirement calculator is vital to securing your financial future. It corresponds to your retirement goal and provides customization with accurate projections to help you make informed decisions about your comfort in retirement. So, take a closer look at the different options presented, and don't forget that the right retirement calculator puts you back on track to your fiscal goals.

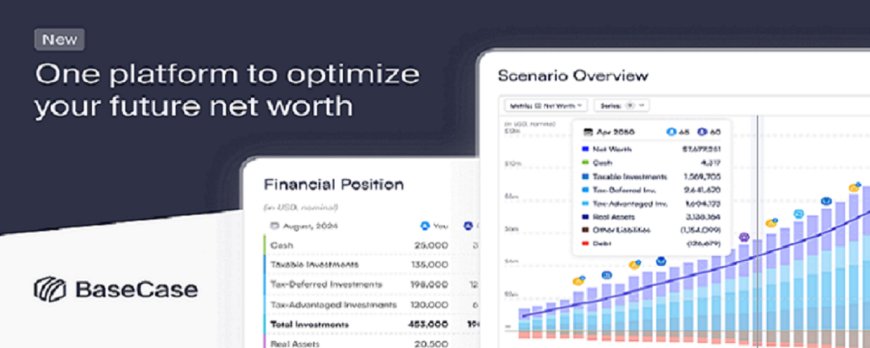

Start planning for your retirement today with the right tools. Explore Base Case for comprehensive calculators for retirement that help you customize your plan and make informed decisions. Take control of your retirement goals and ensure peace of mind for the years ahead!

What's Your Reaction?