AR & AP Services: The Key to Streamlining Financial Operations

In today's fast-paced business environment, efficient financial management is critical for sustained growth.

In today's fast-paced business environment, efficient financial management is critical for sustained growth. Accounts Receivable (AR) and Accounts Payable (AP) are two essential pillars that directly impact cash flow and overall financial stability. Leveraging AR & AP services can be a game-changer for businesses looking to streamline operations and focus on core competencies.

What Are AR & AP Services?

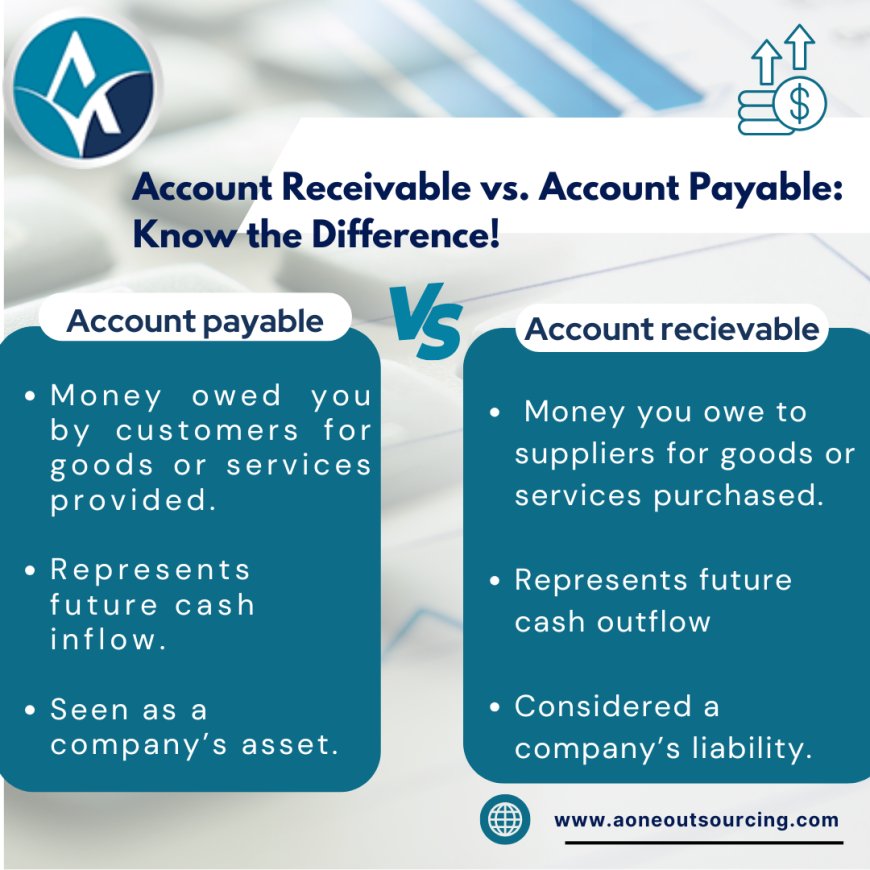

AR (Accounts Receivable) refers to the money owed to a company by its customers for goods or services provided. On the other hand, AP (Accounts Payable) involves the money a company owes to suppliers for goods or services received. Together, these processes are vital for maintaining a balanced cash flow.

Businesses often face challenges in managing these processes efficiently. That’s where outsourcing becomes a strategic solution, enabling companies to optimize financial workflows and reduce overhead costs.

Why Choose Outsourcing for AR & AP Services?

Outsourcing accounts payable and receivable has become a popular choice among businesses due to its numerous benefits. Here’s why:

1. Cost Savings

Managing AR and AP in-house can be expensive, especially for small and medium-sized enterprises. By opting for accounts payable outsourcing services, businesses can significantly reduce costs associated with hiring, training, and maintaining an in-house team.

2. Enhanced Accuracy

Manual processes are prone to errors, which can lead to financial discrepancies. Outsourced providers leverage advanced technology and skilled professionals to ensure accurate and timely processing of invoices and payments.

3. Improved Cash Flow Management

With specialized AR & AP services, businesses gain better control over cash flow. Outsourcing partners monitor payment schedules and follow up on overdue invoices, ensuring steady inflows and timely outflows.

4. Scalability and Flexibility

Outsourcing offers scalability, allowing businesses to adjust services based on seasonal demand or business growth. This flexibility ensures that companies always have the right resources without overcommitting.

5. Focus on Core Business Activities

By outsourcing non-core tasks like AR and AP, companies can focus on strategic growth initiatives, such as product development, market expansion, and customer engagement.

Key Features of AR & AP Outsourcing Services

When partnering with an outsourcing provider, businesses can expect a wide range of services designed to optimize their financial processes. These include:

Accounts Receivable Services

-

Customer invoicing and billing

-

Payment processing and reconciliation

-

Monitoring overdue accounts and sending reminders

-

Credit risk assessment

-

Comprehensive reporting on receivables

Accounts Payable Services

-

Invoice processing and data entry

-

Vendor payment management

-

Expense tracking and reporting

-

Early payment discounts management

-

Fraud prevention and compliance monitoring

Benefits of Outsourcing Accounts Payable and Receivable

Access to Expertise

Outsourcing providers employ professionals with in-depth knowledge of financial processes and compliance standards, ensuring top-notch service quality.

Time Efficiency

Automated workflows and streamlined processes reduce turnaround times for invoice approvals, payment processing, and debt collection.

Advanced Technology

Outsourcing partners use state-of-the-art software and tools for process automation, error reduction, and data security.

Regulatory Compliance

Staying compliant with tax regulations and financial reporting standards is critical. Outsourcing providers ensure adherence to all relevant laws and guidelines.

How to Choose the Right AR & AP Service Provider

Selecting the right outsourcing partner is crucial for maximizing the benefits of AR & AP services. Here are some factors to consider:

-

Experience and Expertise

Look for a provider with a proven track record in accounts payable outsourcing services and a deep understanding of your industry. -

Technology Capabilities

Ensure the provider uses advanced tools and software for seamless integration with your existing systems. -

Customization Options

The provider should offer tailored solutions that align with your business needs and objectives. -

Data Security

Verify that the provider adheres to stringent data protection protocols to safeguard sensitive financial information. -

Customer Support

Choose a partner with a responsive support team to address queries and concerns promptly.

The Future of AR & AP Outsourcing

The demand for outsourcing accounts payable and receivable is expected to grow as businesses increasingly recognize its value in enhancing efficiency and profitability. With advancements in AI and automation, the future of AR & AP outsourcing promises even greater accuracy, faster processing, and improved decision-making capabilities.

Conclusion

Efficient management of AR and AP is crucial for a company’s financial health. By leveraging AR & AP services, businesses can streamline operations, reduce costs, and focus on strategic growth. Whether it’s outsourcing accounts payable and receivable or engaging specialized accounts payable outsourcing services, the benefits are undeniable.

Partnering with a reliable outsourcing provider is the first step toward achieving financial excellence. Take the leap today and experience the transformation in your business operations.

What's Your Reaction?