Ensuring Compliance: How Paystub Creators Help Meet Labor Laws

In today's world of business, ensuring compliance with labor laws is crucial for maintaining a positive reputation, avoiding fines, and ensuring that employees are treated fairly. One of the most effective tools that business owners can use to stay compliant with labor laws is a paystub creator. In this blog, we will discuss how using a paystub creator can help businesses adhere to labor laws and avoid common pitfalls, while also providing employees with transparent and accurate pay information.

What Is a Paystub Creator?

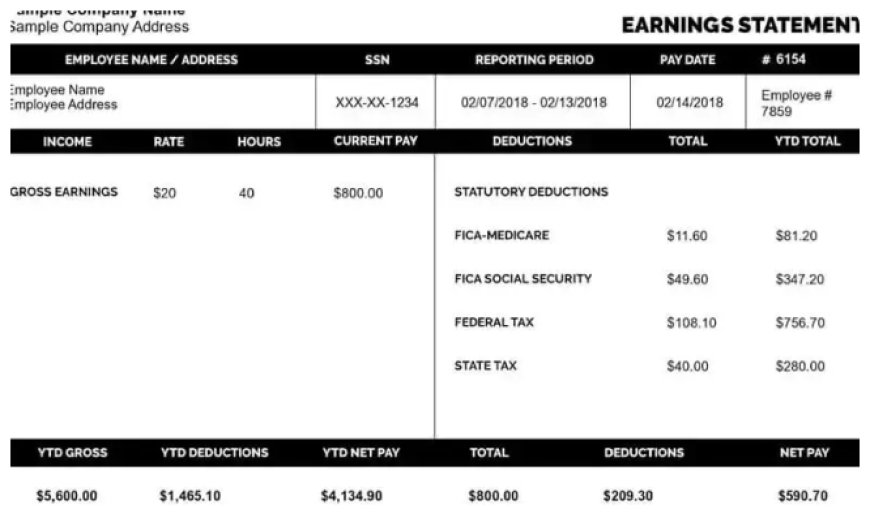

A paystub creator is an online tool or software that helps businesses generate pay stubs (or pay slips) for their employees. Pay stubs provide a detailed breakdown of an employee's earnings for a specific pay period. They include essential information such as gross wages, deductions, taxes, and the final take-home pay. These pay stubs are not only a way for employees to track their earnings, but they also serve as a critical document that helps businesses comply with labor regulations and tax reporting requirements.

The Role of Paystub Creators in Labor Law Compliance

Labor laws in the United States require employers to maintain accurate records of employee wages, hours worked, and other employment conditions. A paystub creator helps ensure that these records are kept up to date and in compliance with federal, state, and local regulations.

Here’s how using a paystub creator can help businesses stay compliant:

-

Accurate Record Keeping

One of the most important aspects of labor law compliance is keeping accurate records of employee compensation. According to the Fair Labor Standards Act (FLSA), employers are required to maintain records of wages, hours worked, and the classification of employees (whether they are exempt or non-exempt). Using a paystub creator ensures that every paycheck is documented accurately, which can be crucial in the event of an audit or legal dispute. The tool can track wages, overtime, and any deductions made, helping business owners keep a clean record of what was paid to employees.

-

Proper Deductions

Labor laws also dictate how various deductions should be handled, including federal and state taxes, Social Security, Medicare, and other voluntary deductions (like health insurance premiums or retirement plan contributions). Paystub creators ensure that these deductions are applied correctly and transparently. They can automatically calculate these amounts based on current tax rates and other regulations, so business owners don’t have to manually calculate these deductions, reducing the chances of error or non-compliance.

-

Overtime Calculations

For non-exempt employees, federal law mandates that they must receive overtime pay for hours worked over 40 in a week. The pay rate for overtime is usually 1.5 times the regular hourly wage. A paystub creator helps calculate overtime automatically, based on the number of hours worked. This ensures that the employer is paying employees correctly and according to the law.

-

State and Local Labor Laws

Labor laws vary from state to state and even from city to city. A paystub creator often includes features that accommodate different state and local regulations. For instance, some states have different minimum wage rates, tax rates, or specific requirements for paid leave, and a good paystub creator will adjust calculations accordingly. This feature helps business owners stay compliant with not just federal regulations, but also the unique labor laws of their location.

-

Transparency and Employee Access

Providing employees with detailed, transparent pay stubs is an essential part of building trust and ensuring compliance with labor laws. Many states require that employees receive a pay stub detailing the specifics of their pay. A paystub creator allows businesses to provide employees with this level of transparency, ensuring that each pay stub clearly shows their earnings, deductions, and the final amount they take home. Moreover, most modern paystub creators allow employees to access their pay stubs online through secure portals, making it easier for them to review and track their earnings. This transparency also reduces the chance of disputes over payment, which can be especially important during audits or inspections.

-

Ensuring Proper Tax Withholding

Proper tax withholding is critical for compliance with both federal and state tax laws. A paystub creator can help calculate the right amount of taxes to withhold from an employee’s paycheck based on their filing status, dependents, and income level. The paystub generator will also ensure that the employer is correctly withholding Social Security and Medicare taxes, which are required by the IRS. It can also calculate state and local taxes, depending on where the business is located.

By using a paystub creator, employers can avoid under-withholding, which could lead to penalties, or over-withholding, which could leave employees frustrated with their take-home pay.

-

Handling Benefits and Other Contributions

Many businesses offer employees benefits such as health insurance, retirement contributions, or paid time off. These benefits require proper accounting and deduction on each pay stub. A paystub creator can easily accommodate these deductions, ensuring that employees see exactly how much is being deducted for benefits and that the amounts are correct. Whether it’s a 401(k) contribution or a health insurance premium, the paystub creator ensures that both the employer and employee are aware of these financial movements, keeping everything compliant with labor laws.

-

Minimizing Errors and Disputes

Manual payroll calculations can lead to errors, whether it’s from miscalculating tax withholdings, failing to account for overtime, or overlooking an employee's hours worked. A paystub creator automates these calculations, significantly reducing the likelihood of human error. By ensuring the accuracy of each pay stub, employers can avoid potential legal disputes, employee dissatisfaction, and even lawsuits over unpaid wages or miscalculations.

-

Filing Accurate Tax Forms

Employers are required to file various forms with the IRS and state tax agencies, such as the W-2 and 1099 forms. These forms report an employee’s earnings and the taxes withheld. A paystub creator can generate detailed reports that help businesses accurately fill out these forms. By ensuring that the paystubs are accurate, the paystub creator simplifies the process of tax reporting, making sure that businesses meet all their tax obligations in a timely manner.

-

Record Retention and Audit Readiness

Labor laws typically require businesses to keep payroll records for a certain number of years (often three years for the FLSA and four years for tax purposes). A paystub creator allows businesses to store these records electronically, ensuring easy access in case of an audit or investigation. These records are also securely stored and can be retrieved quickly, reducing the hassle of managing paper documents or manually tracking down records.

The Benefits of Using a Paystub Creator for Employers

-

Efficiency and Time Savings

Generating pay stubs manually or using outdated methods can take up valuable time. Paystub creators simplify this process by automating calculations and record-keeping, freeing up time for business owners to focus on other aspects of their company. With just a few clicks, employers can generate accurate pay stubs for every employee, saving time and reducing stress.

-

Cost Savings

Hiring payroll professionals or relying on third-party payroll services can be expensive. A paystub creator offers a cost-effective solution, allowing employers to manage their payroll and compliance needs without incurring high fees. Many paystub creators offer affordable pricing plans or even free versions, making them accessible to small businesses with limited budgets.

-

Peace of Mind

With a paystub creator, employers can rest assured that they are meeting labor law requirements. By automating the payroll process, businesses minimize the risk of errors or violations, reducing the likelihood of fines or legal challenges. This peace of mind allows employers to focus on growing their businesses, knowing they are compliant with labor laws.

Conclusion

In a world where labor laws are continually evolving, staying compliant can seem like a daunting task for business owners. However, by using a paystub creator, employers can simplify the process of maintaining accurate payroll records, calculating deductions, ensuring overtime pay, and adhering to federal and state regulations. Paystub creators not only make it easier for businesses to stay compliant with labor laws, but they also promote transparency and trust with employees. With the benefits of automation, accuracy, and efficiency, a paystub creator is an essential tool for any business owner looking to stay ahead in today’s regulatory landscape.

By investing in a reliable paystub creator, you ensure that your payroll system is not only streamlined and cost-effective but also fully compliant with labor laws. This step will not only help you avoid costly mistakes but will also foster a better relationship with your employees, contributing to a healthy, transparent work environment.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What's Your Reaction?