How SharkShop Helps You Monitor and Improve Your Credit Score

How SharkShop Helps You Monitor and Improve Your Credit Score

How SharkShop Helps You Monitor and Improve Your Credit Score

In today’s fast-paced financial landscape, your credit score isn’t just a number; it’s the key to unlocking doors to better loan rates, rental opportunities, and even your dream job. Yet for many, understanding and managing this vital figure can feel like navigating through murky waters.

Enter SharkShop.biz a revolutionary tool designed not only to help you monitor your credit score but also empower you with actionable insights that lead to tangible improvements. Whether you're looking to boost your score for a major purchase or simply want peace of mind in knowing where you stand financially,

SharkShop is here to guide you every step of the way. Dive into our blog post as we explore how this innovative platform transforms the often daunting task of credit management into an engaging and achievable journey toward financial success!

Introduction to Credit Scores and their Importance

Your credit score can feel like a mysterious number that holds the key to your financial future. It influences loan approvals, interest rates, and even job opportunities. Understanding and monitoring this essential figure isn’t just smart—it’s necessary for achieving your financial goals.

But navigating the world of credit scores can be overwhelming. With various factors at play, it’s easy to lose track of where you stand or how to improve. That’s where SharkShop.biz comes in. This innovative platform offers tools designed to simplify credit management and empower you on your journey toward better credit health. Let’s dive deeper into how SharkShop can help you monitor and enhance your credit score effectively!

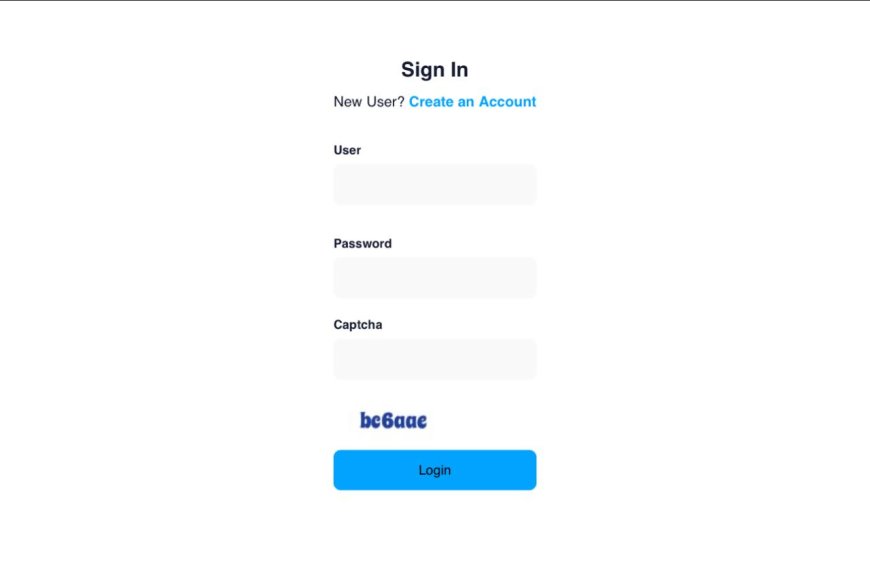

A Screenshot of Sharkshop (Sharkshop.biz) login page

What is SharkShop?

SharkShop is an innovative platform designed to simplify your credit management journey. It provides users with the tools needed to monitor their credit scores effectively.

At its core, SharkShop aims to empower individuals by promoting financial awareness and literacy. With user-friendly navigation, it makes understanding complex credit information accessible for everyone.

The platform aggregates data from all major credit bureaus, ensuring you have a comprehensive view of your financial health. This approach helps you make informed decisions regarding loans and other financial commitments.

SharkShop stands out due to its commitment to personalized support. Users receive tailored resources that guide them through improving their credit profiles over time.

Whether you're starting fresh or looking to enhance existing scores, SharkShop offers essential insights every step of the way. Its focus on real-time updates ensures you're always in the loop about any changes affecting your score.

How SharkShop Helps You Monitor Your Credit Score

SharkShop provides a seamless way to keep an eye on your credit score. With real-time updates and alerts, you’ll never be caught off guard by changes in your credit report. This feature ensures you're always informed about any fluctuations that could impact your financial health.

Accessing credit reports from all major bureaus is another key advantage. SharkShop consolidates this information, allowing users to see their scores from different sources in one place. This makes it easier to understand where you stand.

Personalized tips for improvement are an added bonus. SharkShop tailors advice based on your unique financial situation, guiding you toward better decisions that can enhance your score over time. With these tools at your disposal, managing your credit becomes worry-free and efficient.

- Real-time updates and alerts

Staying informed about your credit score is crucial, and SharkShop makes it effortless. With real-time updates, you receive immediate notifications about any changes to your credit report.

Whether it's a new account opening or a significant shift in your score, you'll know right away. This instant awareness allows you to react quickly and make informed financial decisions.

Alerts are customizable too. Tailor them according to what matters most to you. Want an update when your score drops by a certain amount? Or perhaps you'd like notifications for new inquiries? SharkShop login has you covered.

These timely alerts empower users to take charge of their finances proactively. Instead of waiting for monthly summaries that may come too late, you're always in the loop with SharkShop's advanced monitoring features.

- Access to credit reports and scores from all major bureaus

Accessing your credit reports and scores from all major bureaus is crucial for understanding your financial health. SharkShop simplifies this process by offering a unified platform where you can view all three of your credit reports—Experian, TransUnion, and Equifax—in one convenient location.

This comprehensive access means you're not just seeing numbers; you're gaining insights into how various factors influence your score. Each bureau may report differently, and discrepancies can affect your overall rating.

SharkShop empowers you to spot these inconsistencies quickly. You’ll receive detailed explanations for each entry on the reports, making it easier to understand what actions might boost or harm your score.

With real-time updates available at your fingertips, staying informed has never been simpler. This feature ensures that any changes in your credit profile are promptly communicated so that you can take proactive steps when necessary.

- Personalized credit improvement tips

SharkShop goes beyond just monitoring your credit score. It offers personalized credit improvement tips tailored to your specific financial situation.

When you sign up, the platform analyzes your current credit profile. It identifies areas where you can make meaningful changes. These insights empower you to take action effectively.

For instance, if late payments are dragging down your score, SharkShop will provide strategies for timely bill payment. You might receive reminders or suggestions on setting up automatic payments.

Additionally, the platform may recommend ways to reduce outstanding debt or improve your credit utilization ratio. Simple steps like these can lead to significant improvements over time.

With each tip provided by SharkShop, you're not only informed but also motivated to enhance your financial health. This personalized approach makes a real difference in navigating the complexities of credit management.

How SharkShop Can Help You Improve Your Credit Score

Understanding what influences your credit score is crucial. SharkShop provides insights into the various factors that can impact your rating. From payment history to credit utilization, knowing these elements helps you make informed decisions.

SharkShop doesn’t stop at just information; it offers a personalized credit improvement plan tailored to your needs. You’ll receive actionable steps based on your unique financial situation.

This approach empowers you to tackle specific areas of concern head-on. Whether you're looking to reduce debt or improve payment behaviors, SharkShop guides you every step of the way.

With easy-to-follow tips and strategies, boosting your score becomes manageable and less daunting. By utilizing SharkShop’s resources, you’re not just tracking progress but actively working towards achieving a healthier financial future.

- Understanding factors that affect your score

Your credit score is influenced by several key factors. The most significant is your payment history. Timely payments positively impact your score, while late payments can drag it down.

Credit utilization plays a crucial role as well. This ratio compares how much credit you’re using to your total available credit. Keeping this ratio low demonstrates responsible borrowing habits.

Length of credit history matters, too. A longer history suggests reliability to lenders, which can enhance your score over time.

New accounts and inquiries also contribute to fluctuations in your rating. Opening multiple new accounts at once may raise red flags for potential creditors.

Lastly, the variety of credit types helps round out your profile. Having a mix of revolving and installment loans shows that you can manage different kinds of debt effectively. Understanding these factors empowers you to take charge of your financial health.

- Developing a personalized credit improvement plan

Creating a personalized credit improvement plan is essential for anyone looking to boost their score. SharkShop cc offers tailored strategies that align with your unique financial situation.

First, you'll complete an assessment of your current credit health. This involves reviewing factors like payment history, credit utilization, and outstanding debts. Understanding these elements sets the foundation for meaningful improvements.

Next, SharkShop helps you set realistic goals based on your specific needs. Whether it's paying down debt or increasing available credit, every step counts toward enhancing your score.

Regular progress tracking is another key component. By consistently monitoring changes and adjusting strategies as needed, you can stay motivated and focused on your financial objectives.

With actionable insights from SharkShop at your fingertips, developing a comprehensive plan becomes straightforward and achievable.

Success Stories from SharkShop Users

Many users have experienced transformative journeys with SharkShop. One user, Maria, was overwhelmed by her credit situation. After just a few months on the platform, she improved her score from 580 to an impressive 700.

She credits SharkShop's personalized tips and real-time alerts for keeping her motivated and informed. The step-by-step guidance made all the difference.

Another success story comes from Jason, who had never checked his credit report before using SharkShop. He discovered discrepancies that were dragging down his score. With help from customer support, he rectified those issues in no time.

These stories highlight how effective tools can empower individuals to take charge of their financial health. Users are not merely numbers; they become advocates for their own scores through knowledge and action provided by SharkShop’s resources.

Alternatives to SharkShop for Credit Monitoring

When considering alternatives to SharkShop, several options stand out in the credit monitoring landscape. Each tool has unique features tailored to different needs.

Experian offers its own services that include not only credit score tracking but also identity theft protection. This can be a valuable add-on for those concerned about security.

Credit Karma is another popular choice, providing free access to credit scores and reports. It’s user-friendly and gives personalized recommendations based on your financial habits.

Mint is well-known for budgeting but also includes basic credit monitoring features. Its integration with personal finance management can help users gain a holistic view of their financial health.

Lastly, myFICO focuses specifically on FICO scores, which are widely used by lenders. This service might appeal to individuals who want insights directly linked to their borrowing potential.

Conclusion: Why Choosing SharkShop is the Best Option for Managing Your Credit Score

Navigating the world of credit can be daunting, but with SharkShop.biz, you're not alone. This innovative platform simplifies credit monitoring and empowers users to take control of their financial health. Real-time updates ensure you’re always informed about changes in your score, while access to comprehensive reports from all major bureaus gives a clear picture of where you stand.

What sets SharkShop apart is its focus on personalized improvement strategies. Understanding the factors that impact your score allows for tailored advice that resonates with your unique situation. Developing a customized plan ensures that every step you take is strategic and effective.

Success stories from actual users highlight the transformative power of using SharkShop. Many have seen significant improvements in their scores after implementing recommendations provided by the service.

While there are other options available for credit monitoring, few offer such an engaging user experience combined with robust features like those found at SharkShop. With an emphasis on education and personalized guidance, it stands out as a top choice for anyone serious about improving their credit score.

If you're looking to elevate your financial future through better credit management, choosing SharkShop might just be one of the best decisions you make.

What's Your Reaction?