How to Ensure Your Paystubs Comply with State Regulations

Ensuring that your paystubs comply with state regulations is critical for maintaining legal compliance and avoiding potential legal issues. Paystubs serve as an official record of earnings and deductions, and each state has specific requirements regarding what must be included on these documents. This article will provide a comprehensive guide on how to ensure your paystubs meet state regulations, including using a paystub generator free to simplify the process.

Understanding State Paystub Regulations

Paystub regulations vary by state, but most states require that certain information be included on paystubs. This includes details about the employee's earnings, deductions, and other payroll information. Here’s a general overview of what to look out for:

**1. Employee Information

- Name: Full legal name of the employee.

- Address: Some states require an employee's address to be listed.

- Social Security Number (SSN): While not always required on the paystub itself, the SSN should be handled securely.

**2. Employer Information

- Company Name: The legal name of the employer.

- Address: The business address of the employer.

- Employer Identification Number (EIN): Required in some states for tax purposes.

**3. Pay Period

- Start and End Dates: The beginning and end dates of the pay period for which the employee is being paid.

- Pay Date: The date on which the paycheck is issued.

**4. Earnings

- Gross Pay: Total earnings before any deductions. This includes regular wages, overtime, bonuses, and commissions.

- Hourly Rate/Salary: The employee’s rate of pay or salary, depending on the payment structure.

**5. Deductions

- Taxes: Federal, state, and local taxes withheld.

- Social Security and Medicare: Contributions to Social Security and Medicare.

- Other Deductions: Any other deductions such as retirement contributions, health insurance premiums, and garnishments.

**6. Net Pay

- Total Amount After Deductions: The final amount the employee takes home after all deductions.

State-Specific Regulations

Each state has its own specific requirements for paystubs. For instance:

California:

- Must include the pay period, total hours worked, and all deductions.

- Requires detailed breakdowns of wages, including overtime and regular hours.

New York:

- Requires a detailed record of hours worked for non-exempt employees.

- Paystubs must include the dates of the pay period, employee's name, and the total gross and net wages.

Texas:

- Must include the pay period, employee’s gross and net wages, and the total amount of deductions.

- Does not require detailed hourly breakdowns.

Florida:

- Requires a clear statement of gross pay, deductions, and net pay.

- Does not mandate detailed breakdowns but must include total hours worked if applicable.

Ensure Compliance:

- Regularly review and update paystub templates to meet state-specific regulations.

- Consult with a payroll specialist or legal advisor to ensure all state requirements are met.

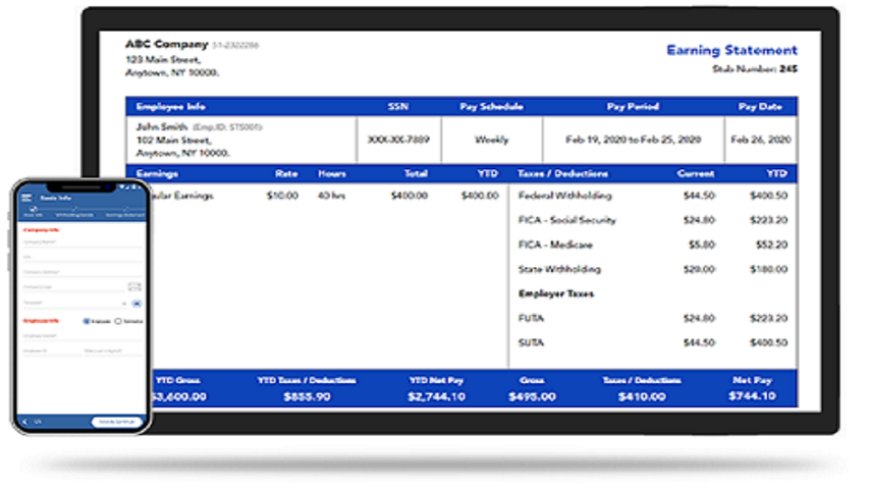

Using a Paystub Generator Free

A paystub generator free can help ensure that your paystubs comply with state regulations by providing customizable templates and accurate calculations. Here’s how to use one effectively:

1. Choose a Reliable Paystub Generator Free

- Selection Criteria: Look for a paystub generator free that offers features aligned with state regulations. Key features include customizable templates, accurate tax calculations, and secure data handling.

- Popular Options: Tools like PayStubCreator and StubCreator are known for their user-friendly interfaces and reliable outputs.

2. Enter Employee and Payroll Information

- Employee Details: Input employee information such as name, address, and Social Security number.

- Employer Information: Enter company details, including name, address, and Employer Identification Number (EIN).

- Earnings and Deductions: Accurately input gross pay, deductions, and any additional earnings like overtime or bonuses.

3. Customize for State Requirements

- Template Customization: Use the generator’s customization features to ensure that the paystub meets your state’s specific requirements.

- Compliance Check: Ensure that all necessary information required by state regulations is included and correctly displayed.

4. Generate and Review the Paystub

- Create Pay Stub: Generate the paystub using the free tool.

- Verify Accuracy: Review the paystub for accuracy, ensuring that all details are correct and comply with state regulations.

5. Distribute and Archive

- Distribute Paystubs: Provide the paystub to employees electronically or as a printed copy, based on their preference.

- Archive Records: Maintain records of all paystubs for future reference and compliance checks.

Common Pitfalls to Avoid

1. Inaccurate Calculations

- Issue: Errors in calculating wages, deductions, or taxes can lead to compliance issues.

- Solution: Double-check calculations using a reliable paystub generator free and review them before finalizing.

2. Missing Required Information

- Issue: Omitting required details can result in non-compliance with state regulations.

- Solution: Ensure all mandatory information is included by reviewing state-specific paystub requirements.

3. Failure to Update for Regulatory Changes

- Issue: Regulations may change, and failure to update paystub templates accordingly can lead to compliance issues.

- Solution: Stay informed about changes in state regulations and update paystub templates and practices as needed.

4. Security Concerns

- Issue: Handling sensitive employee information without proper security measures can lead to data breaches.

- Solution: Use secure paystub generators and ensure that employee data is protected during creation and distribution.

Best Practices for Paystub Compliance

1. Regularly Review State Regulations

- Stay Updated: Keep up-to-date with state laws and regulations regarding paystubs to ensure ongoing compliance.

2. Implement Secure Practices

- Data Protection: Use secure systems and practices for handling and storing paystub information.

3. Consult Experts

- Seek Professional Advice: Work with payroll specialists or legal advisors to ensure that your paystubs meet all state requirements.

4. Use Reliable Tools

- Choose Trusted Tools: Utilize reputable paystub generators that offer compliance features and accurate calculations.

Conclusion

Ensuring your paystubs comply with state regulations is essential for legal compliance and maintaining employee trust. By understanding the key components of a paystub and the specific requirements of your state, you can effectively manage payroll and avoid potential legal issues.

A paystub generator free can be a valuable tool in creating accurate and compliant paystubs. By choosing a reliable paystub generator, customizing paystub templates, and regularly reviewing state regulations, you can ensure that your paystubs meet all legal requirements and provide transparent documentation for your employees.

Maintaining compliance with paystub regulations not only helps in avoiding legal troubles but also contributes to a positive working environment by ensuring that employees receive accurate and detailed information about their earnings and deductions.

What's Your Reaction?