How to Grow Your Business with Mutual Fund Software for Distributors?

Most Mutual Fund Distributors (MFDs) focus on acquiring new clients to grow their business. While this is a common strategy, there’s another effective way to boost your business: engaging your existing clients.

Many clients already use some investment products, but they might not be utilizing others. For instance, a client investing in SIPs might not have explored ELSS or goal-based planning. By introducing them to these additional products and services, you can grow your Assets Under Management (AUM), and a mutual fund software for distributors simplifies this process through its powerful “Grow Your Business” feature. Let’s explore how this tool helps MFDs identify opportunities and strategically expand their business.

What is the ‘Grow Your Business’ Feature?

The ‘Grow Your Business’ feature in back office software empowers MFDs to track and analyze their investors' portfolios with a unique ‘have/don’t have’ mechanism. This report allows you to see which clients are already using specific products or facilities and who isn’t. This targeted approach enables you to guide clients toward other products they may benefit from, ensuring better engagement and portfolio diversification.

With this feature, MFDs can generate product-specific and facility-specific reports to identify untapped opportunities among their existing clientele. Here’s how:

Mutual Fund Product Reports

These reports track which clients have invested in specific mutual fund categories like:

1. SIP (Systematic Investment Plan)

● Identify clients who are already investing in SIPs and those who could benefit from starting one.

2. ELSS (Equity-Linked Savings Scheme)

● Highlight investors who haven’t yet taken advantage of tax-saving ELSS investments.

3. MIP (Monthly Income Plans)

● Spot clients looking for consistent income options and guide them toward MIP.

4. FMP (Fixed Maturity Plans)

● Target clients interested in low-risk, time-bound returns by introducing FMPs.

By tracking investments using these product-specific reports, you can proactively recommend relevant options to your clients.

Facility-Based Reports

Apart from investment products, the mutual fund software for distributors in India also tracks the utilization of additional facilities and tools by investors. These include:

1. Goal Tracker and Financial Planning Reports

● Goal-Based Planning: Check which investors are utilizing goal-based planning and who isn’t. You can guide them to set specific financial goals like buying a house, saving for education, or retirement planning.

● Financial Planning: Help investors who are yet to explore financial planning tools, ensuring they have a structured roadmap to achieve their financial objectives.

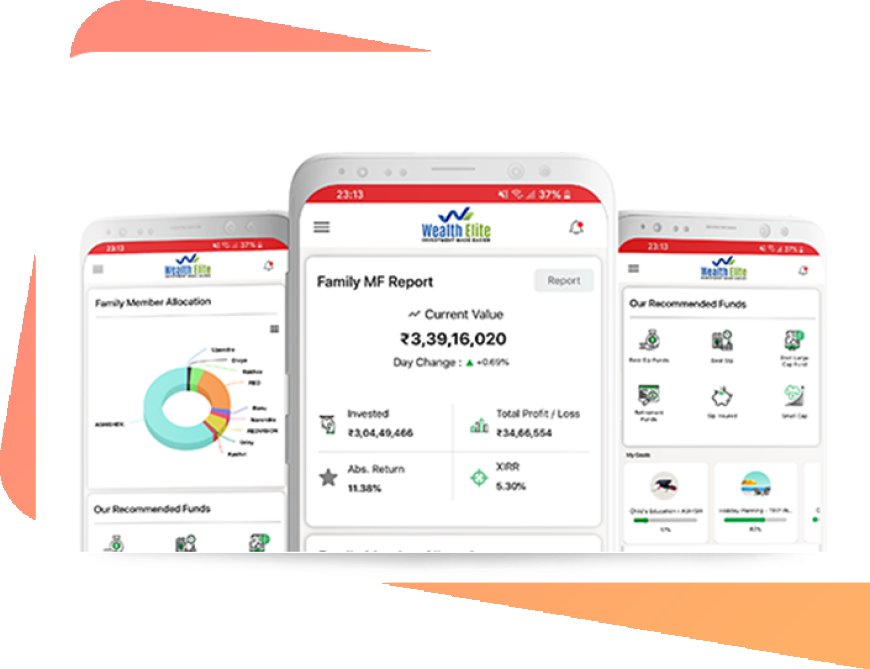

2. Web and Mobile Login Reports

● Identify clients actively using web or mobile app logins for portfolio tracking. Encourage those who aren’t leveraging these facilities to adopt them for better engagement and convenience.

3. BSE Investors Report

● Analyze BSE transactions to determine which clients are already participating in stock exchange activities and introduce others to explore these options for better returns.

Why is This a Great Way to Grow AUM?

The “Grow Your Business” feature offers multiple benefits for MFDs looking to expand their AUM:

1. Targeted Recommendations

The have/don’t have feature enables you to focus your efforts on investors who are more likely to benefit from specific products or facilities. This personalized approach builds trust and fosters stronger relationships with clients.

2. Portfolio Diversification

By introducing clients to new products, you enhance their portfolio diversification, which reduces risk and improves long-term returns.

3. Increased Engagement

Clients who use goal-based planning or financial planning tools are more engaged. This engagement leads to better client retention and higher chances of cross-selling additional services.

4. Optimized Time Management

Instead of chasing new clients, this feature allows you to work smarter by identifying growth opportunities within your existing client base, saving time and effort.

5. Boosts Client Loyalty

By providing personalized solutions, clients see you as a partner in their financial journey, increasing their loyalty and the likelihood of referrals.

How to Get Started?

Implementing wealth management software with the “Grow Your Business” feature is straightforward:

1. Invest in Robust Software: Choose a portfolio management software designed specifically for distributors that includes comprehensive reporting tools.

2. Analyze Investor Reports: Regularly review have/don’t have reports to identify growth opportunities.

3. Propose Tailored Solutions: Use the insights to recommend suitable products or facilities to your clients.

4. Monitor and Follow Up: Track client engagement with new products and maintain regular communication to ensure satisfaction.

Conclusion

The journey to growing your business doesn’t always require finding new clients. By leveraging this feature in the software, you can maximize the potential of your existing clientele. With tools like SIP, ELSS, and financial planning reports, you can identify opportunities, offer targeted solutions, and strengthen client relationships.

Expanding your AUM becomes simpler and more efficient when you use technology to work smarter, not harder. Equip yourself with the right software and take your business growth to the next level.

What's Your Reaction?