How to Join a Chit Fund Without Getting Cheated – Simple Tips That Work

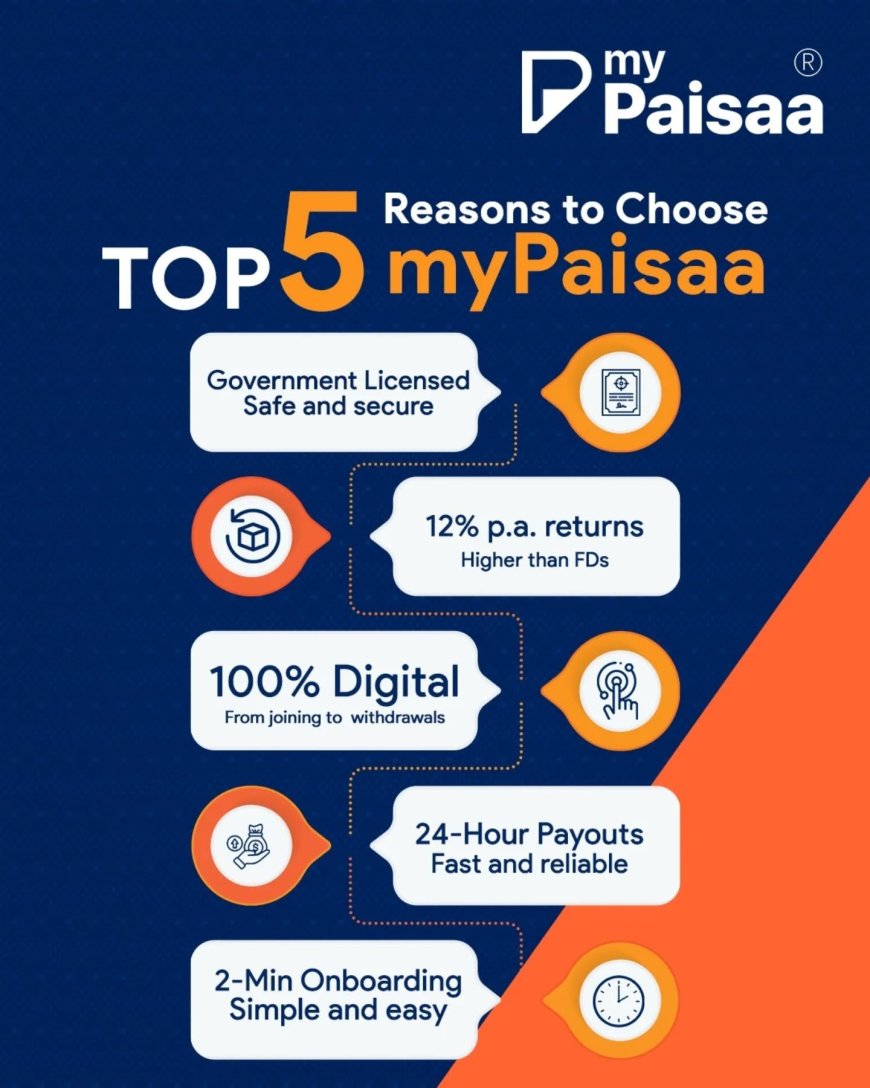

Our digital savings app offers you a superior experience through quick and easy payouts, transparent transactions and customer-first processes.

Chit Funds have been around for generations. For many families and small businesses in India, they’ve served as a trusted way to save money and borrow when needed. But just like any financial tool, Chit Funds can turn into a trap if you're not careful. Fake schemes, unregistered groups, and dishonest organizers have left many people cheated and helpless.

If you're planning to join a Chit Fund, don’t worry — with the right steps, you can stay safe and make your money grow. Let’s break it down in simple terms, with tips that actually work.

First, What Exactly is a Chit Fund?

A Chit Fund is a type of savings and borrowing system. Think of it like this: a group of people comes together and contributes a fixed amount of money every month. That total amount is then given to one member of the group through a bidding or lucky draw system. The cycle continues until everyone has received the lump sum once.

It’s both a way to save money and borrow when needed — all within the same circle.

So, Why Do People Get Cheated?

Sadly, not all Chit Funds are safe. Some are run without any legal registration. Others are set up with the sole purpose of scamming members and disappearing with their money. Lack of paperwork, unclear rules, and blind trust are the biggest reasons people fall into these traps.

But with a little attention and some smart steps, you can join a Chit Fund safely and make it work for you.

1. Only Choose Registered Chit Funds

This is non-negotiable. Always, always pick a Chit Fund that is registered under your state’s Chit Fund Act or under the Registrar of Chits. A registered Chit Fund follows strict legal rules and must report its activities regularly. This adds a strong layer of protection for you.

✅ Take action: Before joining, ask for their registration certificate. If they avoid or delay sharing it, walk away.

2. Check the Promoter’s Background

Would you trust a stranger with your hard-earned money? No, right? The same rule applies here. Check who is running the Chit Fund. Look for experience, past records, and customer reviews.

✅ Tip: Use platforms like My Paisaa to find verified and well-reviewed Chit Fund operators.

3. Understand the Terms Clearly

Before putting a single rupee into a Chit Fund, know the full terms:

-

What is the total tenure?

-

What happens if someone delays payments?

-

What is the commission or fee charged?

-

How is the auction conducted?

If the rules aren’t explained clearly, or the answers feel vague, that’s a red flag.

✅ Ask questions. Take notes. Don't feel shy.

4. Avoid Cash-Only Transactions

Always prefer digital or bank transactions over cash. Cash dealings are hard to track and make it difficult to prove payments if something goes wrong.

✅ Take the smarter path: Use trusted apps like My Paisaa, which offer safe and digital Chit Fund management, right from your phone.

5. Start Small

Don’t jump into a large-value Chit Fund right away. Start small. Get the hang of how things work. Once you feel confident, you can increase your investment.

✅ Pro tip: Choose small-ticket Chit Funds with reliable organizers to build your comfort level.

6. Avoid Peer-Run Chit Funds (Unless Fully Trusted)

A group of friends or neighbors may invite you to join a local Chit Fund. While the idea may sound comforting, most of these are informal and unregulated. If even one person defaults, the whole group suffers.

Unless you completely trust every member and understand the setup, avoid informal Chit Funds.

✅ Better alternative: Join Chit Funds through platforms like My Paisaa, where members are verified and rules are transparent.

7. Get Everything in Writing

Verbal promises don’t hold value. Whether it’s the bidding process, prize amount, or penalty for late payments — get it documented. Reputable Chit Fund companies will always provide a clear agreement or digital terms you can read.

✅ Take charge: Don’t sign anything you don’t understand. If needed, consult a friend or expert.

8. Stay Involved and Informed

Don’t just invest and forget. Attend meetings (or track them online). Stay informed about the auction results, member payments, and fund balance.

A good platform will send you regular updates, alerts, and notifications.

✅ Use tech smartly: With apps like My Paisaa, you can track your entire Chit Fund activity in real time.

Final Thoughts: Chit Funds Can Be Powerful — If You’re Smart About It

A Chit Fund can be a great way to manage your money — giving you access to lump sums when needed and helping you save in a disciplined way. But the risk of fraud is real, and the only way to avoid it is by being aware, cautious, and informed.

Take your time. Ask questions. Use digital tools. And most importantly — don’t invest where you don’t feel 100% safe.

Ready to Join a Safe Chit Fund?

If you’re looking for verified, transparent, and fully digital Chit Funds, give My Paisaa a try. You’ll get:

-

Legally registered Chit Funds

-

Transparent rules

-

Easy-to-use mobile tracking

-

Trusted support

✅ Join smart. Save better. Stay safe — with My Paisaa.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0