How to Make E-Invoicing Work for Small Businesses in Saudi Arabia

The use of e-invoicing in Saudia Arabia is changing the business environment in Saudi Arabia. This is a significant development for small enterprises that want to update their financial procedures. In Saudi Arabia electronic invoicing signifies a substantial transition from conventional paper-based invoicing to a more efficient and precise digital system that improves transactional efficiency. Small firms can automate their invoicing procedures lower manual mistake rates and guarantee compliance with Kingdom regulatory standards by adopting e-invoicing. This change not only makes business financial administration easier, but it also supports the larger goals of efficiency and transparency in Saudi Arabia's economy.

Small businesses must comprehend the advantages of e-invoicing and the best ways to use it as it becomes a crucial component of corporate operations. The goal of e-invoicing's implementation in Saudi Arabia is to help companies reduce operating expenses and achieve better financial record accuracy. This blog will give small businesses useful advice and practical insights on how to successfully adopt e-invoicing in Saudia Arabia so they can take advantage of its benefits and manage this transition with ease.

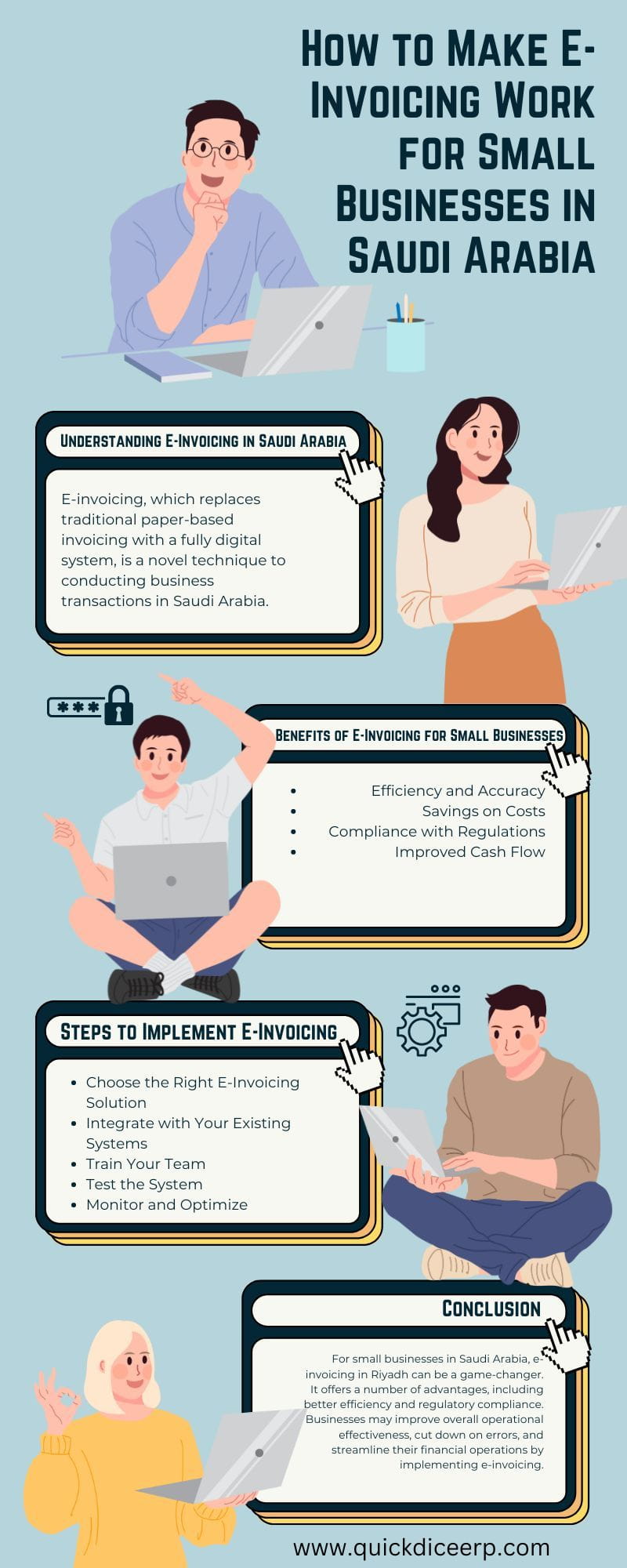

Understanding E-Invoicing in Saudi Arabia

E-invoicing, which replaces traditional paper-based invoicing with a fully digital system, is a novel technique to conducting business transactions in Saudi Arabia. The Zakat, Tax and Customs Authority ordered this change with the intention of improving financial transparency and expediting the invoicing procedure. The system guarantees that all financial records are prepared, delivered and preserved electronically by digitizing invoices, greatly lowering the possibility of errors and fraud. The transition to electronic invoicing is consistent with larger initiatives to modernize the economy and encourage productivity in the business sector.

The transition to electronic invoicing for small firms can seem daunting at first, but there are significant advantages if it's incorporated into regular operations. The digital system helps to maintain regulatory compliance in addition to enabling quicker and more accurate invoicing processing. Comprehending the essential ideas behind electronic invoicing and its benefits will aid small enterprises in managing this shift with efficiency resulting in enhanced budgetary control and decreased administrative workload.

Benefits of E-Invoicing for Small Businesses

1. Efficiency and Accuracy:

By automating the invoicing process and doing away with the need for manual data entry, e-invoicing greatly improves operational efficiency. By lowering the possibility of human error, this technology guarantees correct and timely processing of bills. E-invoicing reduces the possibility of client disputes and helps keep accurate financial records by offering a simplified method of invoice administration. In addition to guaranteeing accurate billing, the improved precision promotes dependability and trust in commercial dealings.

2. Savings on Costs:

For small firms, switching to e-invoicing offers significant cost savings prospects. Businesses can significantly cut their overhead costs by doing away with fees for paper, printing, and postage. Additionally, by automating invoicing procedures, less manual interventions are required, which reduces administrative expenses. Businesses are able to reallocate resources more effectively thanks to this financial efficiency, which supports their overall operational and strategic goals.

3. Compliance with Regulations:

By guaranteeing that all invoices are precisely recorded and easily accessible for audits, electronic invoicing assists small enterprises in adhering to Saudi Arabia's regulatory obligations. The system's capacity to keep thorough electronic records streamlines the compliance procedure and lowers the possibility of fines for non-compliance. Businesses can more easily comply with the Kingdom's tax laws and reporting requirements by incorporating e-invoicing, which encourages a seamless and legal financial operation.

4. Improved Cash Flow:

The fact that e-invoicing improves cash flow is one of its main benefits. Businesses can enhance their total cash flow and accelerate payment cycles by streamlining the invoicing process. The technology makes it easier to track invoices and send out timely reminders, which guarantees that payments are made on time. The smooth processing of invoices contributes to a consistent flow of money, which is essential for maintaining daily operations and fostering corporate expansion.

Steps to Implement E-Invoicing

1. Choose the Right E-Invoicing Solution:

It is essential to choose the correct e-invoicing solution to guarantee that the system satisfies your business requirements and conforms with regional laws. Choose a platform that can easily integrate with the ERP and accounting tools you already have in place. This will streamline operations and cut down on human data entry. Additionally, a user-friendly interface is essential since it will facilitate your team's adoption process. Make sure the solution has strong security measures in place to guard against cyber-attacks and unauthorized access to critical financial data.

2. Integrate with Your Existing Systems:

simplifying the invoicing process requires integrating your selected e-invoicing solution with your present accounting and ERP systems. By enabling automatic data transfer between systems, this integration minimizes the need for human input and lowers the possibility of mistakes. An efficient and consistent workflow is achieved by proper integration, which guarantees that all invoice data is appropriately reflected in your financial records. Additionally it aids in preserving corporate operations continuity without interfering with current workflows.

3. Train Your Team:

Implementing an e-invoicing system properly requires effective training. Make sure all of your staff members have received thorough training so they know how to create, submit, and troubleshoot invoices using the new system. All facets of electronic invoicing, from creating and sending bills to resolving any problems, must to be covered in training sessions. You can make sure that the new system is adopted more successfully and that the transition goes more smoothly by providing your staff with the required training.

4. Test the System:

Do a pilot test to find any possible problems before going fully e-invoicing so you can make the necessary adjustments. Prior to the official release, you can use this trial period to assess the system's performance in a controlled setting and fix any issues. Testing lessens the possibility of problems during actual implementation by ensuring the system satisfies your business needs and performs as planned. Verifying that the system

5. Monitor and Optimize:

The efficacy of the e-invoicing system must be continuously monitored and optimized after it is operational. To find areas that need improvement, evaluate the system's performance on a regular basis and get input from your staff. Make the required improvements and modifications using this information to keep the system effective and in line with your company's objectives. Sustained success with your e-invoicing solution is ensured by ongoing optimization which aids in reacting to any changes in your company environment or regulatory needs.

Conclusion:

For small businesses in Saudi Arabia, e-invoicing in Riyadh can be a game-changer. It offers a number of advantages, including better efficiency and regulatory compliance. Businesses may improve overall operational effectiveness, cut down on errors, and streamline their financial operations by implementing e-invoicing. Not only does this shift support the Kingdom's modernization objectives, but it also aids companies in keeping correct books and guarantees prompt payments. In the dynamic economic environment of the capital, small firms in Riyadh can benefit from the integration of e-invoicing in Riyadh as a way to streamline transactions and improve financial operations management.

Businesses in Riyadh will be in a better position to reap the rewards of this digital revolution if they adopt e-invoicing. Remaining competitive and achieving long-term success will depend on staying ahead of the curve with contemporary financial instruments as the business landscape continues to change. Through adherence to the specified implementation procedures and ongoing system optimization, small enterprises can guarantee a smooth transition to electronic invoicing and prosper in Riyadh's dynamic marketplace.

What's Your Reaction?

![iSQI IREB_CPRE_FL Exam Dumps [2024 Questions] For Perfect Study](https://news.bangboxonline.com/uploads/images/202410/image_430x256_6704b6ebb6287.jpg)