How Venmo Simplifies Payments: A Comprehensive Overview

Venmo imposes certain restrictions on how much money users can receive, particularly for unverified accounts. For unverified accounts, the maximum Venmo amount you can receive and hold is capped at $299.99 per week.

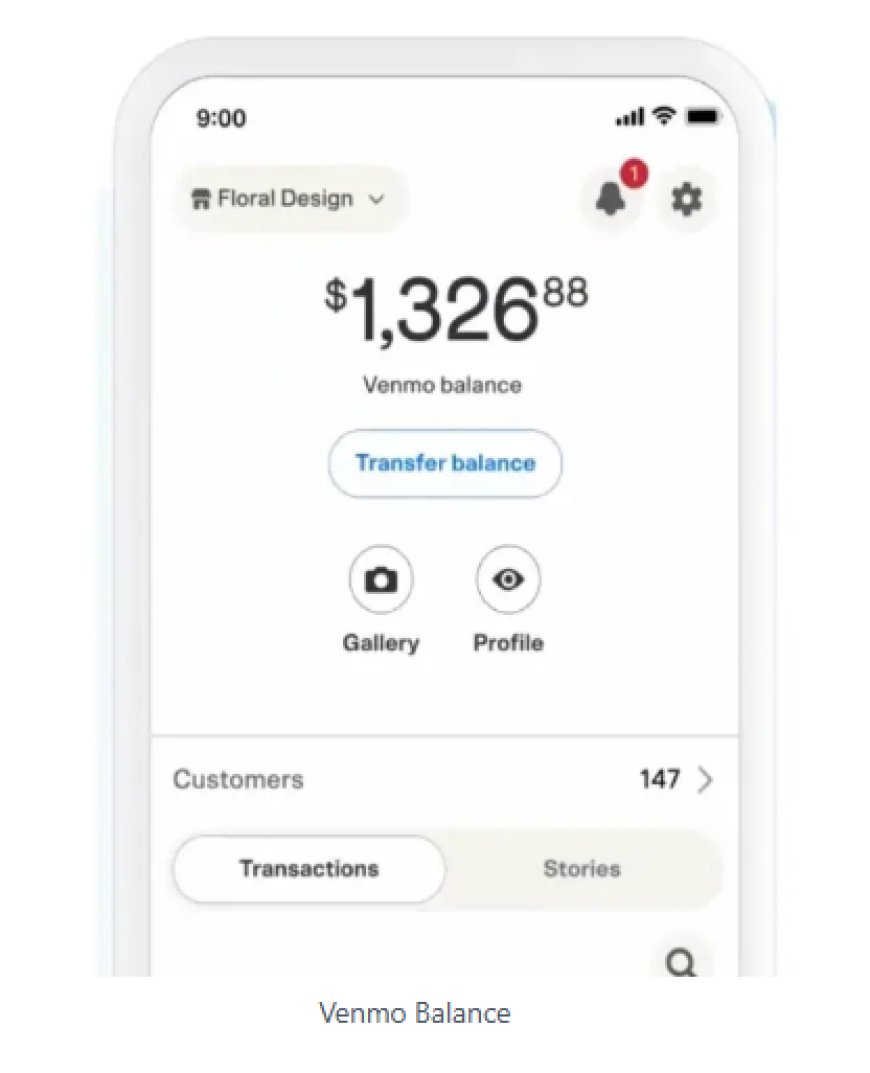

Venmo has revolutionized how we handle digital payments, offering a simple, fast, and reliable platform for transferring money. Whether you’re splitting rent with roommates, paying for a group dinner, or receiving payments for freelance work, Venmo’s versatility makes it a favorite for millions of users. As convenient as it is, understanding the platform’s features, including its Venmo transaction limit and other restrictions, is crucial to maximizing its benefits.

Setting Up Your Venmo Account for Receiving Payments

Creating a Venmo account is the first step toward enjoying its seamless payment capabilities. To get started:

- Download the Venmo App: Available for iOS and Android devices.

- Sign Up: Register using your email address, mobile number, and bank account or debit card details.

- Verify Your Identity: Complete the identity verification process to unlock higher limits and advanced features.

Once your account is ready, you can start receiving payments effortlessly.

Exploring the Different Ways to Receive Money on Venmo

Venmo offers multiple ways to receive money, ensuring flexibility and convenience. Some common methods include:

- Direct Transfers: Friends or customers can send payments directly to your username.

- QR Codes: Generate a personalized QR code for quick and secure transactions.

- Payment Requests: Request money from others by entering their Venmo username or phone number.

These options make Venmo ideal for both personal and business use.

Understanding the Limits on How Much You Can Receive

Venmo imposes certain restrictions on how much money users can receive, particularly for unverified accounts. For unverified accounts, the maximum Venmo amount you can receive and hold is capped at $299.99 per week. However, verified users enjoy significantly higher limits, with no specific cap on incoming funds. It’s important to understand these Venmo account limits to avoid interruptions in transactions.

Factors That May Affect the Amount You Can Receive

Several factors influence your ability to receive funds on Venmo, including:

- Verification Status: Verified accounts have higher Venmo amount limits and fewer restrictions.

- Type of Transaction: Payments from friends typically have fewer restrictions than those involving goods or services.

- Linked Bank Accounts: Having a linked and verified bank account can streamline transactions and reduce limits.

Tips for Maximizing Your Earnings on Venmo

- Verify Your Account: This unlocks higher limits and ensures smoother transactions.

- Encourage Direct Payments: Use QR codes or direct username transfers to receive funds without delays.

- Monitor Limits: Regularly check your remaining Venmo daily limit transfer or weekly transaction caps to avoid declined payments.

- Optimize Bank Transfers: Utilize the Venmo bank transfer limit of $19,999.99 per week to move funds efficiently.

Examples of Common Transactions and Their Payment Amounts

Here are some examples of how Venmo is commonly used:

- Splitting Bills: Sharing a $100 dinner bill among friends.

- Rent Payments: Transferring $1,200 to a landlord.

- Freelance Payments: Receiving $500 from a client for a completed project.

Each of these transactions falls well within the platform’s standard limits for verified accounts.

How to Request Specific Amounts from Friends or Customers

Requesting specific amounts on Venmo is easy and helps ensure clarity in transactions. Here’s how:

- Open the Venmo App: Navigate to the “Request” tab.

- Enter the Username: Type the username, phone number, or email of the person you’re requesting money from.

- Specify the Amount: Enter the exact amount you’re requesting and add a note for context.

- Send the Request: Tap “Request” to notify the sender.

This feature is perfect for requesting payments from friends, clients, or customers in a professional and hassle-free manner.

Security Measures to Protect Your Funds on Venmo

Venmo prioritizes the safety of its users’ funds. To protect your account:

- Enable Two-Factor Authentication: Adds an extra layer of security.

- Monitor Transactions: Keep an eye on your transaction history to detect suspicious activity.

- Set Up PIN or Biometric Authentication: Prevent unauthorized access to your account.

- Be Mindful of Limits: Adhere to the Venmo cash limit and other restrictions to avoid account flags.

Conclusion and Final Thoughts on Using Venmo for Payments

Venmo is an excellent tool for managing payments, whether for personal use or small businesses. Understanding its features, such as the Venmo atm limit, max Venmo transfer, and transfer limit Venmo, allows users to maximize the platform’s potential while avoiding unnecessary disruptions.

By verifying your account, monitoring your transaction limits, and using Venmo’s built-in security features, you can enjoy a seamless payment experience. Start using Venmo today to simplify your financial transactions and manage your funds with ease.

What's Your Reaction?