A paystub is more than just a record of your earnings; it’s a detailed financial document that provides insights into your overall financial health. Understanding each line item on your paystub can help you manage your budget, plan for taxes, and assess your financial stability. Yet, many people overlook the valuable information it contains. By carefully analyzing your paystub, you can make smarter financial decisions that support your long-term goals.

In this comprehensive guide, we'll break down each part of a paystub and explain how it impacts your financial health. Plus, we'll highlight how using a free paystub generator can help you better track and manage your finances.

What Is a Paystub?

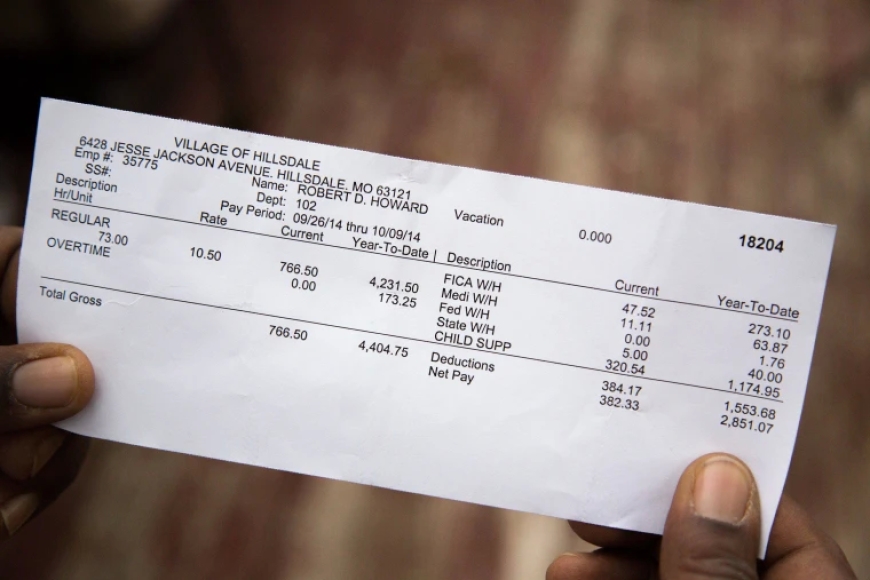

A paystub is a document that accompanies your paycheck, detailing your earnings, taxes, deductions, and contributions for a specific pay period. Whether you're an employee receiving regular paychecks or a freelancer generating your own paystubs, understanding this document is critical to effective financial planning.

Let’s take a closer look at the key sections of a paystub and what they mean for your financial well-being.

1. Gross Income

Your gross income represents the total amount you earn before any deductions. This includes your salary or hourly wages, plus any additional income like bonuses, commissions, or overtime pay.

Why It Matters:

Gross income is the foundation of your financial planning because it represents your total earnings. It’s important for budgeting and tax planning, as most tax brackets and deductions are based on gross income. Understanding your gross income helps you:

- Set realistic financial goals.

- Plan for taxes based on your total earnings.

- Negotiate future salary increases by knowing what you’re worth.

How a Free Paystub Generator Helps:

If you’re self-employed or have variable income, a free paystub generator allows you to track your gross earnings easily. This ensures you have accurate records for financial planning and tax preparation.

2. Net Income (Take-Home Pay)

Your net income, also known as take-home pay, is the amount you receive after all taxes, deductions, and contributions have been subtracted from your gross income. This is the actual amount deposited into your bank account.

Why It Matters:

Net income is critical for budgeting because it’s the amount of money you have to work with after all obligatory payments have been made. If your net income is consistently lower than expected, it may indicate that your tax withholding or deductions are too high, leaving you with less money for daily expenses and savings.

Knowing your net income helps you:

- Create a realistic monthly budget.

- Identify areas where you might reduce deductions (such as taxes or benefits).

- Set aside an appropriate amount for savings and investment.

How a Free Paystub Generator Helps:

Freelancers and business owners can use a free paystub generator to calculate their net income by accounting for all deductions and taxes. This makes it easier to create accurate budgets and plan for expenses.

3. Federal, State, and Local Taxes

Every paystub includes deductions for taxes. These deductions typically include federal income tax, state income tax (if applicable), and local taxes. Your federal tax withholding is based on the information you provided on your W-4 form, while state and local taxes vary by location.

Why It Matters:

Your tax withholdings have a direct impact on your financial health. If too much is withheld, you may be giving the government an interest-free loan. On the other hand, if too little is withheld, you could owe a large sum come tax season.

Understanding how much is being deducted for taxes allows you to:

- Adjust your W-4 form to better match your tax liability.

- Avoid large tax bills or unexpected refunds.

- Plan for annual tax payments.

How a Free Paystub Generator Helps:

For self-employed individuals and contractors, a free paystub generator helps keep track of estimated tax payments. This ensures you set aside the right amount for taxes and avoid penalties at the end of the year.

4. Social Security and Medicare (FICA) Taxes

Social Security and Medicare taxes are mandatory deductions that go toward funding retirement and healthcare for older adults and certain individuals with disabilities. Together, these are known as FICA (Federal Insurance Contributions Act) taxes.

- Social Security Tax: Currently, 6.2% of your wages are deducted, up to a specific wage limit.

- Medicare Tax: 1.45% of your wages are deducted, with no income limit, and high-income earners may be subject to an additional 0.9% Medicare surtax.

Why It Matters:

These deductions are essential for your future financial health because they contribute to the Social Security and Medicare benefits you'll receive in retirement. However, they reduce your current take-home pay, so it’s important to account for these deductions in your budget.

Knowing your FICA contributions helps you:

- Plan for future Social Security benefits.

- Calculate your effective tax rate.

- Ensure that you’re setting aside enough money for retirement outside of Social Security.

How a Free Paystub Generator Helps:

A free paystub generator helps accurately calculate your Social Security and Medicare contributions, making it easier to see how these deductions impact your take-home pay.

5. Employee Benefits and Deductions

Many paystubs include deductions for employee benefits, such as health insurance, retirement contributions, and flexible spending accounts (FSAs).

- Health Insurance: Your contribution to employer-sponsored health insurance plans is usually deducted from your paycheck before taxes, reducing your taxable income.

- Retirement Contributions: Many employers offer retirement plans like 401(k)s, and your contributions may also be deducted pre-tax. Some employers offer a match, which should be reflected on your paystub.

- Other Deductions: These may include life insurance, dental plans, disability insurance, and other benefits.

Why It Matters:

Understanding these deductions helps you evaluate your total compensation package. Employee benefits are a significant part of your financial health, as they provide security in areas like healthcare and retirement.

By examining these deductions, you can:

- Ensure that you’re taking full advantage of employer-sponsored retirement plans, especially if they offer matching contributions.

- Evaluate whether your health insurance premiums are affordable.

- Adjust your benefits selections during open enrollment if needed.

How a Free Paystub Generator Helps:

For freelancers or business owners without employer-sponsored benefits, a free paystub generator allows you to track your personal contributions to retirement accounts, health insurance, and other essential benefits.

6. Year-to-Date (YTD) Totals

Your paystub will usually include year-to-date (YTD) totals for your gross income, net income, taxes, and deductions. These totals represent your cumulative earnings and deductions for the current year.

Why It Matters:

Year-to-date information provides a snapshot of your financial progress throughout the year. It’s particularly helpful for tax planning and monitoring your savings and retirement contributions.

YTD information allows you to:

- Track your income for tax purposes.

- Monitor your progress toward savings and retirement goals.

- Plan for end-of-year tax adjustments or charitable contributions.

How a Free Paystub Generator Helps:

A free paystub generator allows freelancers and small business owners to generate accurate YTD totals, giving them an ongoing view of their financial health throughout the year.

7. Employer Contributions

Some paystubs also list employer contributions to benefits like retirement plans, health insurance, or wellness programs. These contributions do not affect your take-home pay but are part of your total compensation package.

Why It Matters:

Employer contributions add significant value to your total earnings. For example, employer contributions to a 401(k) can significantly boost your retirement savings over time. Understanding these contributions helps you fully appreciate the value of your job beyond just your salary.

Knowing employer contributions helps you:

- Plan your long-term savings strategy.

- Ensure you’re taking full advantage of employer-sponsored programs.

How a Free Paystub Generator Helps:

For those who manage payroll for a business, a free paystub generator can track both employee and employer contributions, ensuring transparency and accuracy for both parties.

Conclusion

Understanding each line item on your paystub is essential for maintaining your financial health. From managing taxes and deductions to maximizing employer-sponsored benefits, every aspect of your paystub plays a role in shaping your overall financial picture. By regularly reviewing your paystub and using the information to adjust your financial strategies, you can make better decisions and achieve your long-term goals.

Using a free paystub generator simplifies this process, allowing you to accurately track your earnings, taxes, and deductions, whether you’re an employee, freelancer, or business owner. With the right tools and a solid understanding of your paystub, you can take control of your financial health and build a secure future.