As a small business owner, managing your company's payroll can be one of the most daunting tasks. Ensuring that your employees are paid correctly and on time is essential, but it can also be time-consuming, especially when you don’t have the resources of a large company. Fortunately, there’s a simple solution: a paystub generator. In this blog, we’ll explore how a simple paystub generator can make your payroll process more manageable, helping you save time, reduce errors, and maintain compliance.

What is a Paystub?

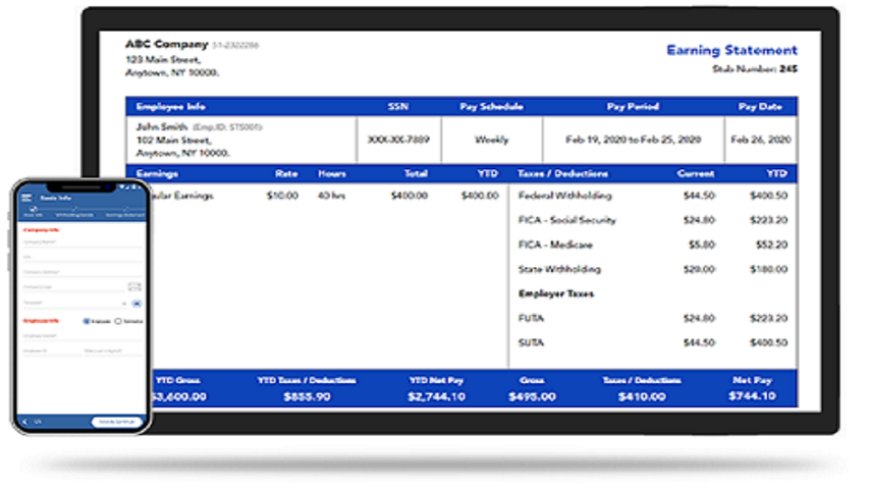

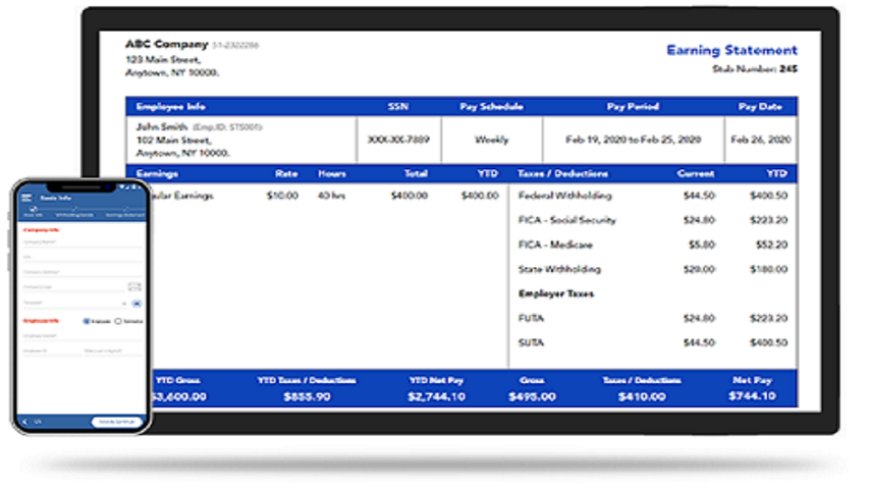

Before diving into the benefits of using a paystub maker, let’s first define what a paystub is. A paystub is a document provided to employees that outlines the details of their paycheck. It typically includes:

- Gross wages: The total earnings before any deductions.

- Deductions: Taxes, retirement contributions, and other deductions taken from the employee’s pay.

- Net pay: The amount the employee takes home after deductions.

- Hours worked: The total number of hours worked during the pay period.

- Employer contributions: Contributions made by the employer, such as health insurance or retirement plan matches.

Providing employees with a paystub is not only good practice, but it's also often a legal requirement, especially in the United States. Paystubs serve as proof of employment and income and can be used for tax filings, loans, and other financial matters.

Why Small Business Owners Should Use a Paystub Generator

Managing payroll is crucial for small business owners, but it doesn’t have to be complicated. Here’s why using a paystub generator can be a game-changer for your business.

1. Saves Time

The biggest benefit of using a free paystub maker is that it saves time. Instead of manually calculating each employee's pay, deductions, and taxes, you can use the generator to automate the process. Most paystub generators only require a few inputs like the employee's name, hours worked, pay rate, and any deductions. With a few clicks, you can create a professional-looking paystub in minutes.

This time-saving feature is especially helpful for small business owners who juggle multiple responsibilities and don’t have the time to spend on complicated payroll tasks.

2. Reduces Errors

Manual calculations are prone to errors. Whether it’s forgetting a deduction or miscalculating an overtime rate, payroll mistakes can lead to unhappy employees and potential legal issues. A paystub generator takes the guesswork out of payroll by automatically calculating everything for you. This reduces the chances of errors and ensures that your employees are paid correctly every time.

With a paystub maker, you can also easily track changes, such as salary adjustments, benefits, or tax rates. These features make the payroll process more accurate and reliable.

3. Keeps You Compliant

As a small business owner, you must comply with various labor laws and tax regulations. These rules change frequently, and staying updated on them can be overwhelming. A paystub generator can help you stay compliant by including required information on each paystub, such as:

- Correct tax deductions (federal, state, and local)

- FICA (Social Security and Medicare) contributions

- Retirement contributions

- Overtime calculations (if applicable)

By automating these processes, you can rest assured that your paystubs meet legal standards and protect your business from potential fines or lawsuits.

4. Easy to Use

One of the main reasons why small business owners prefer a free paystub maker is its simplicity. You don’t need to be a payroll expert or have extensive accounting knowledge to use these tools. Most generators have user-friendly interfaces that guide you through the process step-by-step. Even if you’re new to payroll, you’ll find it easy to create paystubs quickly and accurately.

Additionally, many paystub generators offer free templates or basic versions that are ideal for small businesses. These free options provide the essential features you need without the complexity of more advanced payroll software.

5. Professional Appearance

A paystub maker ensures that your paystubs look professional. Having a well-designed paystub can give your employees a sense of trust and confidence in your business. It shows that you take their payments seriously and that your company is organized.

Most paystub generators allow you to customize the paystub with your company’s name, logo, and other branding elements. This can give your business a polished, professional appearance, which is especially important if you’re looking to impress clients or investors.

6. Records and History

Another advantage of using a paystub generator is that it can create a digital record of all the paystubs you generate. These records can be stored securely for future reference. Whether you need to refer back to a past paystub for tax purposes, or if an employee has a question about their paycheck, having a record of all paystubs can be invaluable.

This digital history also makes it easier for you to manage payroll over time. You can quickly pull up past paystubs, identify trends, or analyze your business's payroll expenses. This level of record-keeping is difficult to achieve with manual payroll methods.

What Features Should You Look for in a Paystub Generator?

When choosing a paystub maker, there are several key features to look for. These features will help ensure that the generator is effective, accurate, and easy to use for your small business needs.

1. Customization Options

Look for a paystub generator that allows you to customize the paystub with your business name, logo, and other details. This helps maintain a professional appearance and adds a personal touch to the paystubs.

2. Tax Calculations

A good paystub maker will automatically calculate tax deductions based on the latest tax rates. This includes federal income tax, state taxes, and FICA (Social Security and Medicare). This feature ensures that your business remains compliant with the ever-changing tax laws.

3. Overtime and Hourly Pay

If your employees are paid hourly or receive overtime pay, make sure the paystub generator can handle these calculations accurately. The generator should be able to compute overtime hours based on your state’s regulations and apply the correct rate.

4. Deduction Tracking

Your paystub maker should allow you to enter various deductions, such as retirement contributions, insurance premiums, or garnishments. This ensures that your employees' pay is correct and that deductions are properly tracked.

5. Easy Export and Print Options

Once your paystub is generated, you should be able to easily export it as a PDF or print it. This allows you to share the paystub with your employees in a format they can keep for their records.

6. Security and Privacy

Since payroll data is sensitive information, ensure that the paystub generator offers adequate security features, such as password protection and secure storage. This is essential for protecting your business and employees' privacy.

Free Paystub Maker: A Great Option for Small Businesses

Many small business owners are looking for ways to reduce costs while still maintaining professionalism. A free paystub maker is an excellent choice because it offers a simple, cost-effective way to manage payroll. While premium payroll software can be expensive, free paystub generators provide the basic functionality needed to create accurate paystubs without any upfront costs.

Free paystub makers usually offer a limited set of features but can still handle the essentials for small businesses. These tools are perfect for startups, freelancers, or businesses with only a handful of employees. If your business grows and you need more advanced features, you can always upgrade to a paid version or more comprehensive payroll software.

Final Thoughts

Running payroll for your small business doesn’t have to be a stressful or complicated task. With a simple paystub generator, you can automate the process, reduce errors, stay compliant, and save time. Plus, many of these tools are free or inexpensive, making them a great solution for small business owners who need a cost-effective way to manage their payroll.

By choosing a paystub maker with the right features and security, you can ensure that your employees receive accurate, timely paystubs while maintaining a professional appearance for your business. Whether you’re just starting or managing a growing business, using a paystub generator is an easy and effective way to keep your payroll in order.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

Get Pay Stub From Starbucks

How To Get Paystub From Zachary

What Is KMTCHTR on Pay Stub?

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

How Does Verizon Paystub Help Ensure Payroll Accuracy and Transparency?