Step-by-Step Guide to Seamless Payment Gateway Integration in Apps

Discover a comprehensive step-by-step guide for seamless payment gateway integration in your applications. Enhance user experience and streamline transactions today.

Step-by-Step Guide to Seamless Payment Gateway Integration in Apps

Including payment gateways in mobile apps is essential to ensuring safe and easy transactions. The secret to improving user experience and accelerating business growth is choosing the best payment gateway and integrating it with ease, whether it's for in-app purchases, subscription services, or e-commerce.

In this article, we'll walk you through the process of incorporating payment gateways into your iOS and Android mobile apps. These methods will help you ensure that your app minimizes payment failures and protects sensitive financial data while providing customers with a flawless payment experience.

Why Is Payment Gateway Integration Important?

It is impossible to overstate how crucial it is to incorporate a trustworthy payment gateway into your app. Increased rate of conversion and client retention might result from allowing users to make transactions immediately within your app using an integrated payment system. It also lessens the friction associated with checkout, which would otherwise result in abandoned shopping carts or irritated users.

A Comprehensive Guide for Integrating Payment Gateways

1. Choose the Correct Payment Gateway

It's important to choose the best payment gateway for your business needs before integrating it. Here are important things to consider about:

· Platform Compatibility: Verify that the payment method works with the iOS and Android operating systems and any cross-platform development tools you may be utilizing (like Flutter or React Native).

· Security Features: To secure consumer data, look for advanced security features like tokenization, two-factor authentication (2FA), and encryption.

· Transaction Fees: examine and compare each gateway's fees, taking into account any potential hidden expenses.

· Global Currency Support: Make sure the payment gateway accepts a variety of currencies if you're serving customers worldwide.

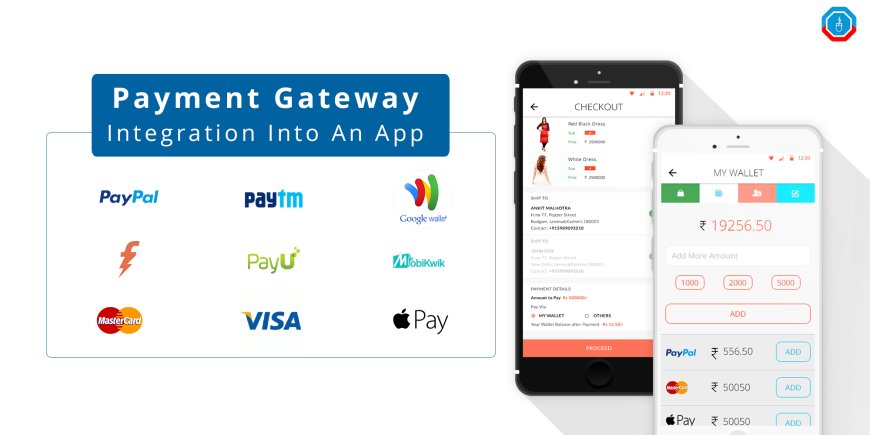

· Popular choices: PayU, PayPal, Stripe, and Razor Pay are a few of the frequently utilized payment gateways.

2. Create a Merchant Account.

You must open a merchant account with the selected payment gateway provider to start accepting payments. Before being transferred to your business account, all payments will be handled through this merchant account. To get your account activated, be careful to adhere to the exact requirements set forth by each provider as they have their onboarding procedure.

3. Include the SDK for the Payment Gateway.

To include the payment system in your mobile app, you must use the Software Development Kit (SDK) that is provided by each payment gateway. The tools required to enable communication between your app and the payment provider are provided by the SDK.

· iOS Integration: The SDK often offers Objective-C or Swift integration choices if you're creating an iOS application.

· Android Integration: The SDK supports Java or Kotlin for Android apps, and the gateway's documentation outlines how to integrate it easily.

· Cross-Platform Integration: A lot of modern apps are developed with the help of cross-platform frameworks, such as Xamarin, React Native, and Flutter. To facilitate seamless integration, the majority of payment gateways also provide SDK support for these technologies.

4. Test the Integration in Sandbox Mode

Before making the payment gateway live in your app, it's important to thoroughly test the integration using the payment gateway's sandbox or test mode. This allows you to simulate real payment transactions without actually processing any payments. During this phase, ensure the following:

· Add and test different payment methods like credit/debit cards, UPI, and wallets.

· Validate the error-handling mechanism for failed transactions.

· Ensure that payment notifications and confirmations are sent correctly.

· Testing is crucial to identify any bugs or glitches in the payment flow that could

5. Ensure Payment Security

While payment gateways come with built-in security features, it's essential to implement additional security measures to ensure safe transactions:

· SSL/TLS Encryption: Secure your app with SSL/TLS certificates to encrypt data transferred between your app and the payment gateway.

· Tokenization: Sensitive information like credit card numbers should be tokenized, meaning they are replaced with unique tokens that are useless to hackers.

· PCI DSS Compliance: Ensure that your app is compliant with the Payment Card Industry Data Security Standard (PCI DSS), which is the global standard for handling card information.

6. Verify the Security of Payments

Even if payment gateways have built-in security elements, extra security measures must be put in place to ensure secure transactions:

· SSL/TLS Encryption: To encrypt data exchanged between your app and the payment gateway, secure it with SSL/TLS certificates.

· Tokenization: Credit card numbers and other sensitive data should be tokenized or substituted with distinct tokens that are unusable by hackers.

· PCI DSS Compliance: Make that your application complies with the worldwide standard for managing credit card information, known as the Payment Card Industry Data Security Standard (PCI DSS).

7. Design an Easy-to-Use Payment Interface

Your app's ability to process payments efficiently and intuitively is essential to its success. Abandoned transactions may result from an intricate or unclear interface. Remember the following design principles:

· Minimal Fields: To prevent overwhelming consumers with lengthy forms, only ask for the necessary information.

· Safe Payment Methods: To facilitate speedier purchases in the future, let users safely store their favored payment method.

· Mobile Optimisation: Since most customers will finish transactions on their phones, make sure the payment form is fully responsive and mobile-friendly.

8. Deal with Non-Payment Errors With elegance

Payments will inevitably fail, and how well you handle them can make or break the user experience. To handle unsuccessful payments:

· Display Clearer Error Messages: When a payment fails, provide a polite and clear error message so the user knows what went wrong.

· Retry Options: Give customers the choice to try their payment again or select another payment method.

· Transaction Logs: Maintain a record of all successful and unsuccessful payments so that your staff and users can investigate any problems later on.

The Best Methods for Integrating Payment Gateways

· Keep the Payment Process Simple: Avoid making the payment process excessively complicated by adding too many steps

· Allow guest checkout: To keep potential consumers from leaving, let them make purchases without having to register for an account.

· Update Frequently: To prevent bugs and security flaws, update your payment gateway SDK and app frequently.

· Monitor Payment data: To make sure your payment system is operating effectively, periodically examine data like transaction volume, failure rates, and processing times.

Conclusion

To ensure that users of your mobile app have a safe and effective transaction experience, seamless payment gateway integration is a must. You may give your consumers a simple and safe payment experience by following the above-described processes, which include choosing the appropriate payment gateway, guaranteeing security, and conducting extensive testing.

Whether you're a startup looking to expand your app or a Mobile Application Development Firm in Noida, adding a payment gateway is an essential first step in raising income and improving user satisfaction. To make sure your payment solutions are tailored to the current market trends, keep up with the most recent advancements in mobile app development technology.

What's Your Reaction?