Understanding the Benefits of an FPB Credit Report for Financial Planning

Discover how an FPB Credit Report can help you plan your financial future. Learn the key benefits and strategies for financial success.

When it comes to securing a strong financial future, understanding your credit report is one of the most important first steps. One specific type of credit report that is becoming increasingly essential for financial planning is the FPB (Financial Profile Bureau) Credit Report. An FPB Credit Report is a comprehensive tool that provides insight into your financial behavior and helps both individuals and businesses make informed financial decisions. In this article, we will explore what an FPB Credit Report is, how it can be used, and the benefits it offers for personal and business financial planning.

What is an FPB Credit Report?

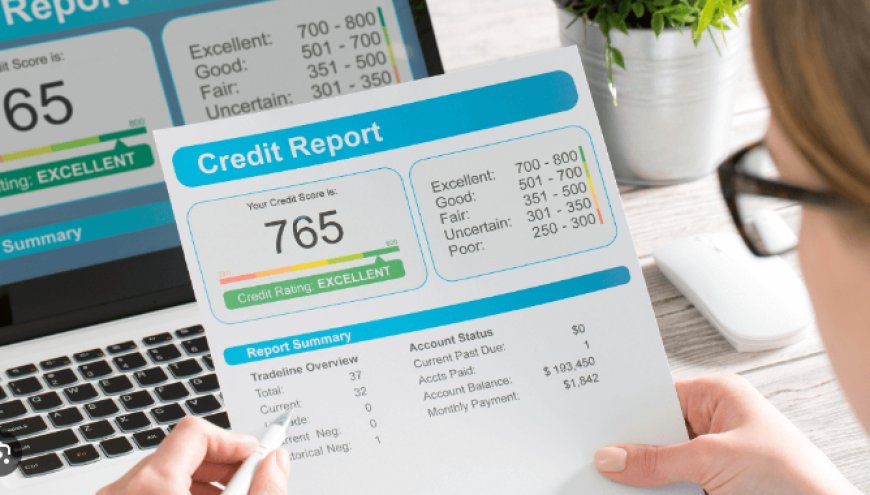

An FPB Credit Report is a detailed financial profile that includes a person’s credit history, including credit scores, payment history, outstanding debts, and any public records related to financial matters. It is issued by the Financial Profile Bureau, a credit reporting agency that aggregates financial data from various sources, including banks, credit card companies, and loan agencies.

The report provides insights not only into creditworthiness but also into other financial behaviors that might affect a person’s financial decisions, such as patterns of spending, saving, and managing debts. By understanding these factors, individuals and businesses can better navigate the financial landscape and make more strategic decisions for their future.

For a more in-depth look at how FPB Credit Reports work and their specific components, check out the article on the FPB Credit Report Explained.

Key Components of an FPB Credit Report

Before we dive into the benefits, it’s important to understand what an FPB Credit Report contains. This will give you a clearer picture of how it can help in financial planning.

-

Credit Score: This number, typically ranging from 300 to 850, indicates your creditworthiness. A higher score suggests good credit habits, while a lower score may indicate a history of missed payments or high debt levels.

-

Payment History: This section details your history of payments on loans, credit cards, mortgages, and other financial obligations. It will include any late payments, defaults, bankruptcies, or foreclosures.

-

Credit Utilization: This measures how much of your available credit you are using. A high credit utilization rate (i.e., using a large portion of your credit limit) can indicate financial distress and may lower your score.

-

Outstanding Debts: This section lists your current debts, including credit cards, student loans, mortgages, and any other outstanding financial obligations.

-

Public Records: This includes any legal judgments or liens against you, such as tax liens or bankruptcy filings.

-

Credit Inquiries: When you apply for credit, the lender will perform a “hard inquiry” on your credit report. This section shows all inquiries made within the past two years.

The Importance of an FPB Credit Report in Financial Planning

-

Improving Your Credit Score

One of the primary benefits of obtaining an FPB Credit Report is its ability to help you understand your credit score and how it impacts your financial planning. By reviewing the report, you can identify areas where your score might be negatively affected, such as missed payments or high credit utilization. This knowledge enables you to take proactive steps to improve your score, such as paying down high-interest debt, disputing errors, or negotiating payment terms.

-

Debt Management

Debt management is a crucial aspect of financial planning. An FPB Credit Report gives you a clear picture of all your outstanding debts, including the amounts owed and the interest rates associated with them. With this information, you can prioritize paying off high-interest debts first and explore options for consolidating or refinancing loans to lower monthly payments. Additionally, knowing how your debts affect your credit score can help you make more informed decisions on whether to take on new debt or reduce existing liabilities.

-

Better Loan Terms and Interest Rates

When applying for loans, whether for a home, car, or business, your credit report plays a significant role in determining the terms of the loan. A good FPB Credit Report will demonstrate a history of responsible credit management, increasing your chances of securing loans with favorable interest rates. On the other hand, if your credit report reveals significant issues, such as missed payments or high debt, lenders may offer loans with higher interest rates or even deny the application altogether. By monitoring and improving your credit report, you can secure better terms on loans, saving money in the long run.

-

Financial Goal Setting

A thorough review of your FPB Credit Report can help you set more realistic and achievable financial goals. Whether you are planning to buy a home, save for retirement, or pay off student loans, your credit report provides a snapshot of your financial health. By understanding your strengths and weaknesses, you can create a more tailored financial plan that aligns with your goals. Additionally, the report can help you track your progress over time, ensuring you stay on track and make adjustments when necessary.

-

Identifying Errors and Fraud

One of the most critical reasons to review your FPB Credit Report regularly is to catch any inaccuracies or signs of identity theft. Errors on credit reports are more common than you might think and can significantly affect your credit score. By checking your report frequently, you can identify incorrect information—such as accounts you don’t recognize or wrong payment history—and dispute it with the credit bureau. Additionally, if you spot any fraudulent activity, you can take steps to protect yourself, such as freezing your credit or reporting the fraud to the relevant authorities.

-

Building or Rebuilding Credit

For individuals with limited credit history or those who have experienced financial setbacks, an FPB Credit Report provides the first step toward building or rebuilding credit. By understanding what impacts your score—such as timely payments and responsible credit usage—you can make smart decisions to improve your credit over time. If you have a low or no credit score, the FPB Credit Report can show you where to start, such as applying for a secured credit card or becoming an authorized user on someone else’s credit card.

-

Tailored Financial Advice

Financial planners and advisors often use credit reports to provide personalized advice to clients. With an FPB Credit Report, your advisor can offer insights into strategies that align with your current financial situation. Whether it’s recommending debt reduction methods, suggesting investment strategies, or advising on how to leverage your credit for financial goals, having an FPB Credit Report allows for more informed and effective guidance.

How to Use Your FPB Credit Report for Effective Financial Planning

Now that you understand the benefits of an FPB Credit Report, let’s explore how to use it effectively for financial planning.

-

Regularly Check Your Report

Make it a habit to check your FPB Credit Report at least once a year to ensure it’s up-to-date and accurate. This allows you to spot any discrepancies or areas that need improvement early on.

-

Set Credit Score Goals

If your credit score is not where you want it to be, set specific, measurable goals to improve it. Focus on paying off high-interest debt, reducing credit utilization, and avoiding late payments.

-

Review Debt and Set Repayment Plans

Using the information from your FPB Credit Report, create a detailed debt repayment plan. Pay off the most expensive debts first and consider consolidating or refinancing loans for better terms.

-

Use Your Report to Make Informed Decisions

Before applying for any major loan or credit card, check your FPB Credit Report to understand how your current financial situation will impact the terms and rates offered. This can help you avoid unnecessary hard inquiries and select the best financial products for your needs.

Conclusion

An FPB Credit Report is a powerful tool in your financial planning arsenal. By offering a clear and comprehensive look at your financial history, it allows you to make informed decisions, improve your credit score, manage debt more effectively, and ultimately secure a brighter financial future. Whether you are looking to build credit, buy a home, or plan for retirement, understanding and utilizing your FPB Credit Report can set you on the path to financial success.

What's Your Reaction?