Venmo Payment Restrictions? Here’s How to Increase Your Limit

For users without verified accounts, Venmo restricts sending up to $299.99 every week; once verified users register their bank accounts or debit/credit cards they can increase this limit up to $4,999.99 weekly payments.

Venmo, operated by PayPal, was designed to make peer-to-peer (P2P) transactions effortless and user-friendly. Although it is renowned for its ease of use, there are certain restrictions set up to stop fraud, protect users and meet regulatory requirements. One such restriction is Venmo payment limit that limits how much users can send or receive per timeframe or mobile check deposit feature which enables deposits of up to $5,000 depending on verification status as well as type of check deposited.

Venmo limits can vary depending on whether your account is authentic, the nature of its transactions and your account history. People without verification generally face lower limits for transactions; once verified however, Venmo allows users to raise these thresholds; making this platform ideal for businesses and individuals requiring higher thresholds for payments.

What Is the Current Pay Limit on Venmo?

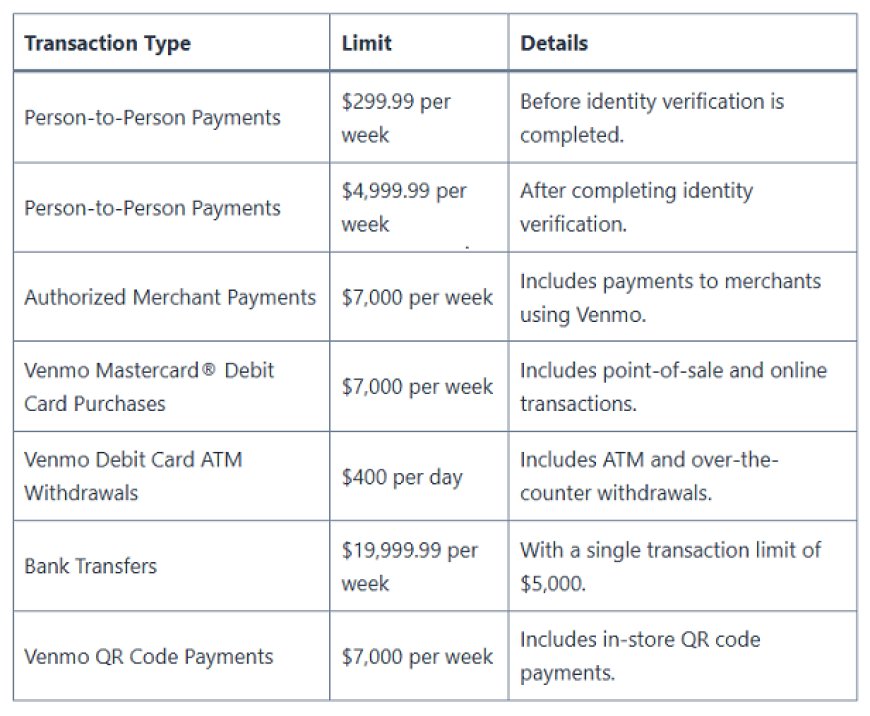

Below mentioned are the different types of pay limits on Venmo:

· Venmo Sending Limit: For users without verified accounts, Venmo restricts sending up to $299.99 every week; once verified users register their bank accounts or debit/credit cards they can increase this limit up to $4,999.99 weekly payments.

· Venmo Receiving Limit: For most users, Venmo receiving limit can often exceed its sending limit by several orders of magnitude - potentially reaching as much as $10,000 weekly in some cases for personal and/or business transactions.

· Venmo Transfer Limits: Venmo also places limits on how much can be transferred between connected bank accounts, instantaneous fund transfers with 1.75 percent fees or regular transfers over $25,000 weekly and immediate transfers up to $2,000 per transaction are limited by Venmo's restrictions.

How Can Users Increase Their Pay Limit on Venmo?

Verifying your account is the quickest and easiest way to increase Venmo sending limit. To verify their identity, Venmo asks users for certain personal data relating to themselves - to do this, you must:

· Open the Venmo app

· Click on the Identity Verification

· Enter Your Full Name, Birth Date and Your Greeting

· Enter the final four digits of your Social Security Number (SSN).

· Verification takes about one minute, after which your account can now access higher transaction limits - up to $4,999.99 per week in verified Venmo transactions.

What are the Common Reasons for Hitting the Pay Limit on Venmo?

As an active user, it can be easy to exceed your Venmo limit on transactions. Below are a few reasons that could cause you to reach that limit:

· Users who receive or send large sums of money every day often reach their daily or weekly limits. Businesses or anyone who frequently sends money should remain cognizant of these restrictions.

· Even if you only make one major transaction per year, smaller payments may add up and exceed your Venmo limit.

· Customers without verified Venmo accounts are limited to transactions with lower limits; verifying your account could significantly expand them.

· Venmo limits apply not only when receiving and sending money but also when making bank account transfers. Multiple large transfers made quickly can exceed your account limit.

How to Manage Your Transactions to Avoid Reaching the Venmo Limit?

If your payments keep exceeding the limit on Venmo, consider these strategies to keep payments under control:

· Make sure that all steps necessary have been taken to establish your identity; this is the most efficient way of unlocking more limits.

· Divide large sums over several days so as not to go beyond your weekly spending limit.

· For payments exceeding certain limits, such as bank transfers or PayPal. There may also be better platforms with larger transaction limits like Amazon Payments.

· Be mindful of how much of your transactions exceed the limit on Venmo to determine whether they have exceeded it.

What are the Alternatives to Venmo for Larger Transactions?

If your payments exceed what Venmo allows, there may be other alternatives worth exploring:

· PayPal: PayPal's global reach makes it an attractive solution for international money transfers and large transactions.

· Zelle: Zelle offers users an efficient and safe method for moving large sums of cash directly between bank accounts.

· Cash App: Cash App works like Venmo by enabling users to transfer money between accounts; however, each limit may better fit your specific requirements.

· Bank Transfers: When it comes to large transactions, traditional banks' wire transfers or transfers have greater transaction limits that they are capable of handling.

How to Contact Venmo Support for Help with Pay Limits?

If you need assistance regarding or exceeding the payment limits on Venmo, reach out to their support team immediately. Here is how:

· Utilizing Venmo App: Open the Venmo App and tapping three lines in the upper left corner will open it, followed by "Help" which provides access to support articles and contact options from Venmo support.

· By visiting: Visit Venmo's support page to access FAQs and contact information.

· Phone Support: If you require help with issues like limit increases or other similar concerns, Venmo support offers direct phone support that can assist in any matter.

FAQ

Can I increase my Venmo limit without verifying my identity?

As with all transactions using Venmo, Venmo requires its users to undergo identity verification to access higher limits for transactions. Verifying your identity will unlock greater restrictions for sending and receiving.

What is the Venmo sending limit for unverified accounts?

Venmo unverified accounts have a limit on sending that is $299.99 weekly until they undergo verification; then this limit increases to $4,999.99 weekly.

How long does it take for Venmo to approve my identity verification?

Venmo usually completes its identity verification in just minutes; however, the process could take up to 24 hours in certain instances.

Can Venmo increase my limit if I ask?

Sometimes you may contact Venmo support and request an increase. Venmo may grant it depending on your transaction history and activity within your account.

How can I avoid hitting the Venmo limit?

To stay within your Venmo sending limit, consider verifying your account, splitting large transactions into separate ones, or moving onto other platforms for greater opportunities.

What's Your Reaction?